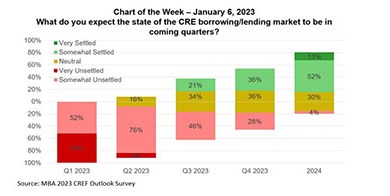

MBA Chart of the Week Jan. 12, 2023: CRE Lending/Borrowing

Commercial real estate markets are entering 2023 amid a great deal of uncertainty and, as a result, a significant slowdown in activity. Leaders of top commercial real estate finance firms believe that overall uncertainty will dissipate over the course of the year, but with a host of factors that will drag – rather than boost – the markets in 2023.

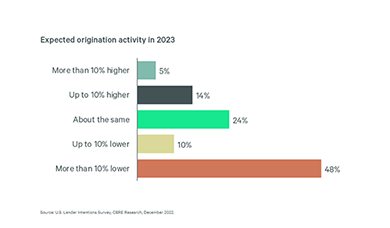

Lender Intentions Survey: Less Origination Activity Expected

Lenders cite rising interest rates, a looming recession and possible lower property valuations as their greatest challenges at the moment, reported CBRE, Dallas.

Colliers: Real Estate Market Should Start Stabilizing in Mid-2023

The global real estate market should start to stabilize by mid-2023, said Colliers, Toronto.

Brick-and-Mortar Groceries Show Resilience

The grocery sector continues to show impressive resilience despite inflation, supply-chain issues and labor shortages, reported Placer.ai, Los Altos, Calif.

Dealmaker: MetroGroup Secures $23M for California 1031 Exchange

MetroGroup Realty Finance, Newport Beach, Calif., secured $22.6 million in financing for a southern California 1031 exchange transaction.

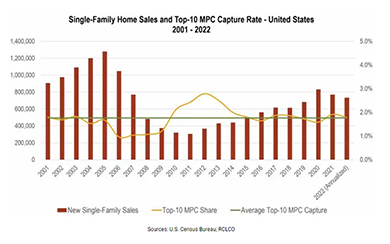

Master-Planned Communities See Sales Decline

RCLCO, Bethesda, Md., reported master-planned communities--just like the broader U.S. housing market--saw a decline in home sales last year compared to 2021.

CMBS Delinquency, Special Servicing Rates Increase

The commercial mortgage-backed securities delinquency and special servicing rates both increased in November, according to Trepp LLC and DBRS Morningstar.