Freddie Mac: Apartment Investment Market Index Further Declines

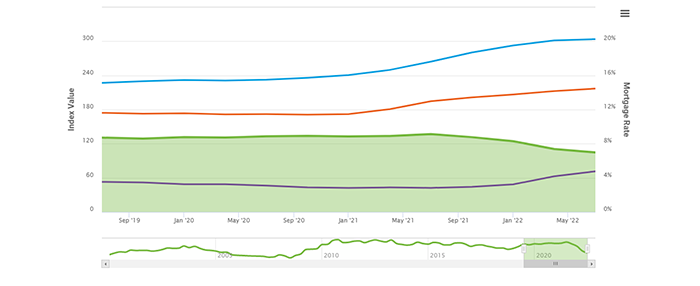

The Freddie Mac Multifamily Apartment Investment Market Index declined 5.4% in the third quarter. The index is down 23.5% year over year.

Steve Guggenmos, Vice President of Research & Modeling with Freddie Mac Multifamily, noted the index decreased nationwide and in all 25 specific markets studied on both a quarterly and annual basis. He cited record mortgage rate growth as the primary reason.

“Rising mortgage rates continue to fuel a decline in the Apartment Investment Market Index,” Guggenmos said. “Property prices and net operating incomes, although positive, are now decelerating, further fueling the decline.”

Guggenmos said multifamily fundamentals remain consistent and strong, “but there’s no question that higher rates are having an effect,” he said.

Over the quarter, AIMI decreased nationally and in all 25 markets Freddie Mac studied.

• National net operating income growth was 2.0% and all but two metro areas experienced growth. The fastest grower was San Diego at 4.5% while Phoenix and Las Vegas saw NOI declines of -1.3% and -0.7%, respectively.

• Property prices grew nationally and in just over half the markets. Price growth slowed significantly compared with last quarter and is now lower than the long-run average.

• Mortgage rates increased by 58 basis points during the third quarter, one of the largest quarterly increases in the report’s history going back to 2000.

Over the past year, the index decreased nationally and in all 25 markets, once again driven by large mortgage rate increases. The nation and 20 of the 25 metros experienced the largest annual AIMI decline since the series started in 2000.

• NOI growth was universally positive. It is now slowing, but still exceeded 10% in more than half the metros studied. Miami led the way with 21.6% annual growth.

• Property prices grew in the nation and in every market examined. Like NOI growth, property price growth is slowing compared with last quarter. Nine metros grew by less than 10%, while four metros saw sub-3% growth.

• Mortgage rates increased by 194 basis points–by far the largest annual increase in the entire history of the AIMI going back to 2000.