Employment Holds Steady, Slowing Slightly

November employment numbers slowed slightly from October, the Bureau of Labor Statistics reported Friday.

The report said total nonfarm payroll employment increased by 263,000 in November, and the unemployment rate was unchanged at 3.7 percent. Last month, revised figures showed growth of 284,000, up from 261,000. September numbers revised down, from 315,000 to 269,000.

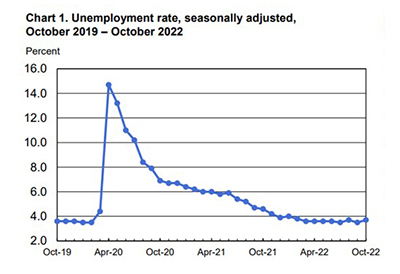

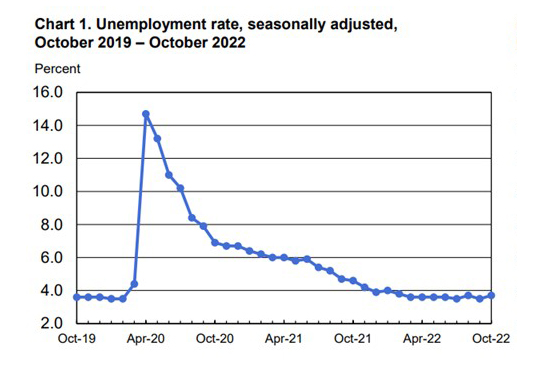

The number of unemployed persons was essentially unchanged at 6.0 million in November. Both the labor force participation rate, at 62.1 percent, and the employment-population ratio, at 59.9 percent, were little changed in November and have shown little net change since early this year. These measures are each 1.3 percentage points below their values in February 2020, prior to the coronavirus pandemic.

“Despite this better-than-expected report, MBA is holding to its forecast of a recession in the U.S. in the first half of 2023,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “While the payroll survey showed a slower pace of growth, the household survey again showed an outright decline in employment – with a drop of 138,000 in November. With other data showing declines in job openings and increases in announced layoffs, we do expect further weakening ahead, with the unemployment rate likely to reach 5.5 percent by the end of 2023.”

Fratantoni said a weakening job market will eventually be a negative for the housing market, as it will reduce demand. “However, reaching the Federal Reserve’s goal of reducing inflation will be a benefit to those still in a position to buy a home, as it will bring down mortgage rates and improve affordability,” he said.

“The labor market remains very strong,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “Services are very labor-intensive and job openings are highest in service-providing industries, like healthcare, leisure and hospitality, and retail trade. Service sector occupations have also seen some of the fastest wage growth, as employers compete to attract and retain employees. For example, average hourly earnings in leisure and hospitality increased 6.4% year over year in November, compared with 5.1% for all employees.”

However, Kushi noted the jobs report shows labor supply recovery as measured by the labor force participation rate has stalled, and even slightly reversed, while wage growth remains strong. “The Fed is hoping that slowing wage growth will make its job a little easier, but this report is discouraging,” she said.

“The labor market remains far too hot for the Fed’s liking, and it will take much slower growth in employment and wages to return inflation to the central bank’s 2% target on a sustained basis,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “A downshift to a 50 bps rate hike in December seems likely, but the Fed still has a ways to go in its tightening cycle.”

“Today’s report shows that recent monetary tightening has, to this point, had minimal impact on labor markets,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “The strong wage growth in particular leads us to believe the Federal Reserve will not soon deviate from their expected course of additional tightening.”

The report said average hourly earnings in November for all employees on private nonfarm payrolls rose by 18 cents, or 0.6 percent, to $32.82. Over the past 12 months, average hourly earnings have increased by 5.1 percent. Average hourly earnings of private-sector production and nonsupervisory employees rose by 19 cents, or 0.7 percent, to $28.10.

The average workweek for all employees on private nonfarm payrolls declined by 0.1 hour to 34.4 hours. In manufacturing, the average workweek for all employees decreased by 0.2 hour to 40.2 hours, and overtime declined by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls decreased by 0.1 hour to 33.9 hours.

“Although wage growth picked up last month, it remains below the pace of inflation, meaning that households will increasingly have a difficult time managing these higher costs,” Fratantoni said.