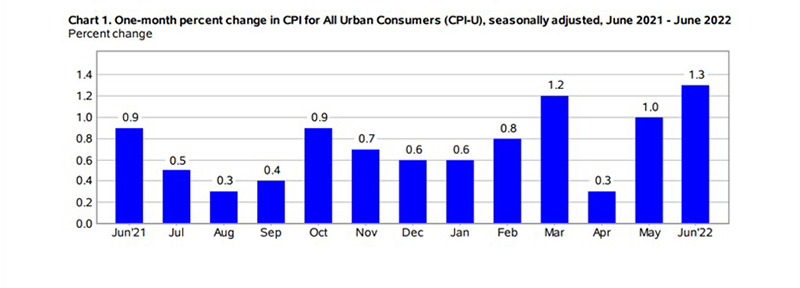

Soaring Gas, Food Prices Drive June Consumer Price Index to 40-Year High

Broad-based increases in major price categories, particularly gas and food, drove the U.S. Consumer Price Index up by 1.3 percent in June month over month and by 9.1 percent year over year—the largest annual increase since 1981, the Bureau of Labor Statistics reported Wednesday.

The all-items index increased by 9.1 percent for the 12 months ending June, the largest 12-month increase since the period ending November 1981. The all-items less food and energy index rose by 5.9 percent over the past 12 months. The energy index rose by 41.6 percent over the past year, the largest 12-month increase since the period ending April 1980. The food index increased by 10.4 percent for the 12-months ending June, the largest 12-month increase since the period ending February 1981.

Month over month indexes for gasoline, shelter and food were the largest contributors. The energy index rose by 7.5 percent over the month and contributed nearly half of the all-items increase, with the gasoline index rising 11.2 percent and the other major component indexes also rising. The food index rose 1.0 percent in June, as did the food at home index.

The index for all items less food and energy rose by 0.7 percent in June, after increasing by 0.6 percent in the preceding two months. While almost all major component indexes increased over the month, largest contributors were indexes for shelter, used cars and trucks, medical care, motor vehicle insurance and new vehicles. The indexes for motor vehicle repair, apparel, household furnishings and operations and recreation also increased in June. Among the few major component indexes to decline in June were lodging away from home and airline fares.

“The June CPI was expected to be hot, but [Wednesday’s] report downright burns” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “CPI inflation in June surged past what were already eye-wateringly high expectations. Even more troubling, the drivers behind the upside miss were broad-based and mostly in the ‘core’ components…Price gains for goods such as apparel and vehicles showed no signs of easing, while inflation for services such as shelter and medical care continued to grind higher.”

House said it will take at least several consecutive monthly inflation readings of slowing price growth for the Federal Reserve to start to believe that it has the current inflation episode in check. ‘[Wednesday’s] CPI release offers monetary policymakers zero reassurance that they are on that path at present,” she said. “A 75 [basis point] rate hike at the upcoming FOMC meeting on July 27 appears to be the floor rather than the ceiling for what the central bank will do to combat this relentless price pressure.”

“The accelerating inflation means there’s a lot more work for the Federal Reserve to do. Another 75-point increase in the federal funds rate is almost assured,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “Monetary policy tightening is definitely curtailing demand for housing, but we won’t see the ‘inflation benefit’ for a while to come. Bottom line – headwinds abound for the Federal Reserve inflation fight.”

Kushi noted shelter inflation, which accounts for nearly 40 percent of Core Consumer Price Index (excludes food and energy) increased at the fastest pace since 1991, rising 5.6% year over year. “One headwind for the Fed’s fight against inflation – shelter inflation is delayed up to six to twelve months,” she said. “Rapid growth in rent expense over the last year is only now beginning to hit the headline CPI figure, which means there’s more upward pressure to come.”

On a more optimistic note, House, said some of the sting from the report will be soothed as early as next month. “Since mid-June, however, gasoline prices have retreated a little more than 7%,” she said. “Natural gas prices have also tumbled and should bring some relief to utility bills over the next couple of months. Food inflation looks set to moderate as well, with gains in related commodity prices having already backed off their ripping pace before rolling over in June. Consumer prices for food at home advanced 1.0% in June, but we suspect more significant easing ahead as raw material, transportation and wage costs have started to cool.”