To the Point with Bob: How Policymakers Can Empower Mortgage Lenders To Deliver More Relief To Borrowers

A debate broke out last week among industry commentators about the meaning and importance of mortgage lender margins during the COVID-19 pandemic. The conversation matters because it could impact the policies that govern the industry and affect people’s ability to obtain affordable mortgage loans and pursue the American Dream.

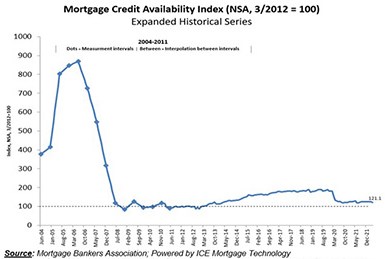

April Mortgage Credit Availability Slips

Mortgage credit availability fell in April, the second straight monthly decrease, the Mortgage Bankers Association reported Tuesday.

CFPB: ECOA Protects Borrowers After Applying for, Receiving Credit

The Consumer Financial Protection Bureau on Monday published an advisory opinion affirming the Equal Credit Opportunity Act—a federal civil rights law protecting individuals and businesses against discrimination in accessing and using credit—bars lenders from discriminating against customers after they have received a loan, not just during the application process.

CoreLogic: 2021 Refinance Closing Costs Remain at Less Than 1% of Loan Amounts

CoreLogic subsidiary ClosingCorp, San Diego, said national average closing costs for refinances increased by more than 4 percent in 2021, but remained less than 1 percent of the average refinance amount.

MBA Education, Superus Careers Partner on Mortgage Career Exchange Marketplace

MBA Education, the career advancement arm of the Mortgage Bankers Association, and Superus Careers, a U.S.-based employment recruiting firm, announced a partnership for mortgage professionals to maximize their employment options.

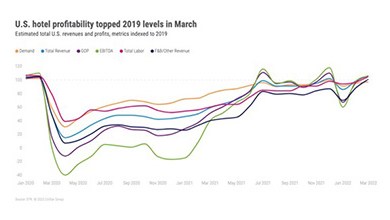

U.S. Hotel Profitability Reaches 28-Month High

STR, Hendersonville, Tenn., said March U.S. hotel gross operating profits reached their highest levels since 2019.