MBA Forecast: 2022 Commercial/Multifamily Lending to Hit Record $1 Trillion

SAN DIEGO — Total commercial and multifamily mortgage borrowing and lending is expected to break $1 trillion for the first time in 2022, the Mortgage Bankers Association reported Monday at its 2022 Commercial/Multifamily Finance Convention and Expo.

‘Rise and Thrive:’ Bob Broeksmit, CMB, Opens CREF22

SAN DIEGO—Mortgage Bankers Association President & CEO Bob Broeksmit CMB, opened the MBA 2022 Commercial/Multifamily Finance Convention and Expo with a welcome back—it was the first live CREF Convention since 2020—and a call to action.

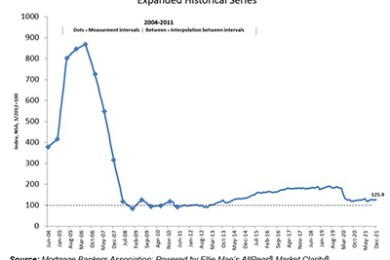

January Mortgage Credit Availability Reaches 5-Month Low

Mortgage credit availability fell to a five-month low in January, the Mortgage Bankers Association reported Tuesday.

HUD Removes Temporary COVID-19 Underwriting Guidelines for Multifamily Transactions

HUD on Monday announced it would remove temporary COVID-19 underwriting guidelines for multifamily transactions under Section 223(f) of the National Housing Act, a move commended by the Mortgage Bankers Association.

MBA: 2022 Commercial/Multifamily Mortgage Maturity Volumes to Increase 12 Percent

SAN DIEGO — The Mortgage Bankers Association said $248.8 billion of the $2.6 trillion (12 percent) of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2022, a 12 percent increase from the $222.5 billion that matured in 2021.

Wells Fargo Leads MBA 2021 Year-End Commercial/Multifamily Servicer Rankings

SAN DIEGO — The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes as of December 31. At the top of the list of firms is Wells Fargo Bank N.A., with $735 billion in master and primary servicing.