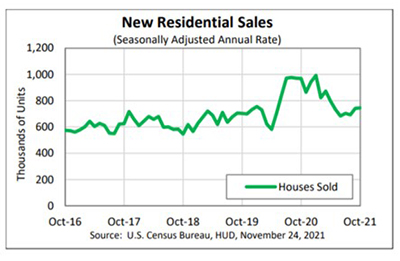

October New Home Sales Up 0.4%

New home sales in October rose for the second straight month, albeit just slightly, HUD and the Census Bureau reported Wednesday.

The report said sales of newly build homes rose to a seasonally adjusted annual rate of 745,000, up by 0.4 percent from the revised September rate of 742,000, but 23.1 percent lower than a year ago (969,000).

Regionally, sales were mixed. In the largest region, the South, sales rose by 0.2 percent in October to 450,000 units, seasonally annually adjusted, from 449,000 units in September but fell by nearly 17 percent from a year ago. In the second-largest region, the West, sales fell by 1.1 percent to 184,000 units in October from 186,000 units in September and fell by 33.1 percent from a year ago.

In the Midwest, sales rose by 11 percent in October, seasonally annually adjusted, to 81,000 units from 73,000 units in September but fell by 28.3 percent from a year ago. In the Northeast, sales fell by nearly 12 percent to just 24,000 units in October from 30,000 units in September and fell by nearly 27 percent from a year ago.

The median sales price of new houses sold in October 2021 rose to a record-high $407,700; the average sales price rose to $477,800. The seasonally adjusted estimate of new houses for sale at the end of October rose by 10,000 to 389,000, representing a supply of 6.3 months at the current sales rate.

Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif., said despite the uptick in inventories, builders continue to face supply-side challenges, including building material supply-chain bottlenecks and difficulty in finding skilled labor that make it hard to start building.

“The outlook for new-home sales is largely dependent on the amount of new construction being built and the demand for new homes,” Kushi said. “Demand remains strong, as millennials continue to age into their prime home-buying years, rates remain low and the economy improves. The lack of existing homes for sale to meet this growing demand nationwide is supportive of new construction. Yet, as we know, builders are facing supply-side headwinds that make it more difficult and costly to build.”

Mark Palim, Deputy Chief Economist with Fannie Mae, Washington, D.C., said downward revisions to previous months suggest that supply and labor constraints may be restricting sales more than previously thought.

“The overall report continues to demonstrate the difficulties builders are facing working through their order backlogs as demand for new homes remains robust,” Palim said. “The primary constraints on sales remain the supply chain disruptions and labor scarcity slowing the pace of completions. We expect that builders will be able to gradually work through their order backlogs as these conditions ease, supporting increases to new home sales during the rest of Q4 and into 2022.”