BREAKING NEWS

Applications Rise in MBA Weekly Survey

Despite mortgage rates reaching their highest level in four months, mortgage applications increased last week, albeit slightly, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending October 8.

CBRE, Dallas, said office space offered for sublease registered its first monthly decline in August since the pandemic started.

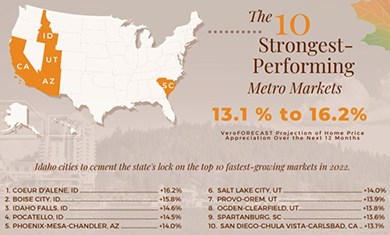

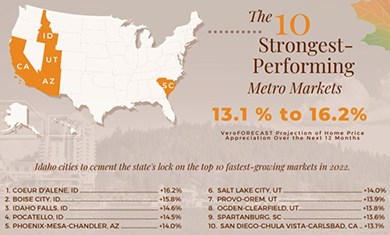

Veros Real Estate Solutions, Santa Ana, Calif., said home price appreciation shows no signs of slowing as 2022 approaches.

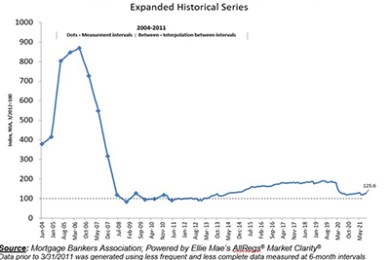

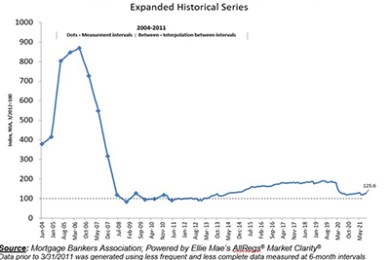

Mortgage credit availability increased for the third straight month in September to its highest level in five months, the Mortgage Bankers Association reported Tuesday.

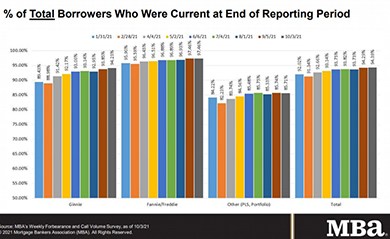

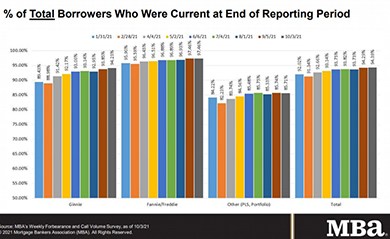

Mortgage borrowers exited forbearance at the fastest rate in more than a year, the Mortgage Bankers Association reported Monday.

Lenders that start with potential and then give applicants the opportunity to improve their score can meaningfully grow revenue.

WFG’s Enterprise Solutions has a trio of proven products ready to boost lender efficiency as the market shifts to origination loans.

Ginnie Mae, Washington, D.C., reported mortgage-backed securities issuance volume for fiscal year 2021 grew to a record $939 billion, with issuance for September coming in at $73 billion.

Meridian Capital Group, New York, arranged $57 million in financing for Indigo Apartments and Peaks at Gainesville, two Gainesville, Ga., multifamily properties.

The pandemic was a major lesson that taught businesses to stay prepared for the uncertain future. So, let’s get into the minds and hearts of the lenders and borrowers, and identify which factors could help sustain the lending business in the coming decade.

We must remember to encourage people to buy homes they can afford and educate them on the costs that go with owning a home. That includes advising consumers not to borrow as much money as they possibly can, lest they become “house poor” and miss out on being able to create a more financially secure future for themselves and their families.

Environmental, Social and Governance criteria is an investment strategy focused on making the world a better place. This is not a new idea; versions of sustainable investing trends have emerged in the past. But the explosive growth and rapidly increasing capital allocation toward “ESG” friendly assets is unprecedented.

Kevin Peranio is a director of AXIS Lending Academy. He is also the chief lending officer for PRMG, one of the nation's largest mortgage lenders, where he oversees all loan production.