Unemployment Claims Up 2nd Straight Week

Initial claims for unemployment insurance rose for the second straight week, the Labor Department reported yesterday, but their impact appears to have diminished amid stronger jobs reports and a growing U.S. economy.

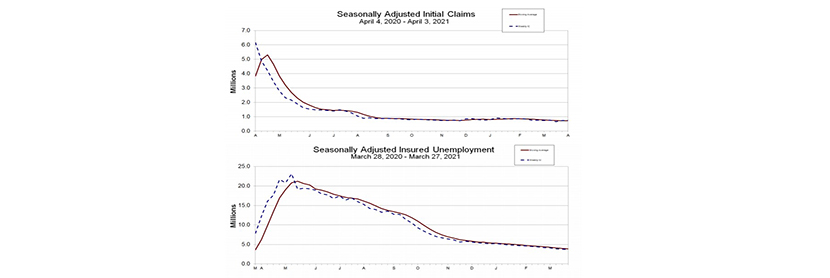

For the week ending April 3, the advance figure for seasonally adjusted initial claims rose to 744,000, an increase of 16,000 from the previous week, which revised up by 9,000 from 719,000 to 728,000. The four-week moving average rose to 723,750, an increase of 2,500 from the previous week’s revised average.

The advance seasonally adjusted insured unemployment rate was unchanged at 2.6 percent for the week ending March 27. The advance number for seasonally adjusted insured unemployment during the week ending March 27 fell to 3,734,000, a decrease of 16,000 from the previous week’s revised level. This is the lowest level for insured unemployment since March 21, 2020, when it was 3,094,000. The four-week moving average fell to 3,862,000, a decrease of 105,750 from the previous week’s revised average.

The advance number of actual initial claims under state programs, unadjusted, totaled 740,787 in the week ending April 3, an increase of 18,172 (or 2.5 percent) from the previous week. Seasonal factors had expected an increase of 2,208 (or 0.3 percent) from the previous week. Labor reported 6,161,308 initial claims in the comparable week in 2020. In addition, for the week ending April 3, 53 states reported 151,752 initial claims for Pandemic Unemployment Assistance.

The advance unadjusted insured unemployment rate fell to 2.8 percent during the week ending March 27, a decrease of 0.1 percentage point from the prior week. The advance unadjusted level of insured unemployment in state programs totaled 4,031,531, a decrease of 67,664 (or -1.7 percent) from the preceding week. Seasonal factors had expected a decrease of 51,374 (or -1.3 percent) from the previous week. A year earlier the rate was 5.6 percent and the volume was 8,158,208.

Labor said the total number of continued weeks claimed for benefits in all programs for the week ending March 20 fell to 18,164,588, a decrease of 50,862 from the previous week. It reported 3,443,666 weekly claims filed for benefits in all programs in

the comparable week in 2020.

“The second consecutive increase in weekly claims to 744K and the modest increase in the four-week average stand in contrast to nearly all other reads on the labor market at present, which point to the recovery progressing,” said Sarah House, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “Hiring has picked up substantially, with 916K jobs added in March. Business surveys corroborate stronger job growth, with the ISM manufacturing and services employment indices both jumping last month. Job openings according to both the BLS and Indeed.com have surpassed their pre-COVID levels. And even from households’ perspective, the labor market has improved recently, with the difference between the share of consumers viewing jobs as ‘plentiful’ versus ‘hard to get’ in March seeing its biggest jump since June.

In other words, House said, “there is little to suggest that the labor market recovery is once again stalling, let alone backsliding, as recent claims figures hint. Instead, the sideways move likely reflects the usual weekly noise—made especially difficult this time of year by the variable timing of Easter—as well as ongoing issues related to backlogs, substantial churn in some industries and even fraud.”

House said although the labor market is far from fully healed, the improving public health picture and ample policy support should push both initial and continuing claims lower in the months to come.