Housing Market Roundup Apr. 9, 2021: Remote Work Drives Demand; Where Home Price Appreciation Outpaces Earnings

Here’s a quick summary of some housing reports that came across the MBA NewsLink desk this week:

Redfin: Remote Work Continues to Drive Record Demand for Second Homes

Redfin, Seattle said the number of buyers who locked in mortgage rates for second homes shot up a record 128% year over year in March. That marks the 10th straight month of 80%-plus annual growth. Data are based on a Redfin analysis of mortgage-rate lock data from real estate analytics firm Optimal Blue.

The report noted pandemic-driven demand for second homes is soaring as many affluent remote workers opt to spend at least part of their time in vacation destinations, even as some companies are planning for workers to return to the office. The annual rise in demand for second homes is nearly quadruple the 34% year-over-year gain for primary homes.

“The Palm Springs housing market is incredibly busy, with an influx of vacation-home buyers from Los Angeles and San Francisco,” said local Redfin agent Nisa Sheikh. “Many of them are tech workers who can do their jobs remotely, and they enjoy the weather and lifestyle here in the desert. People don’t want to vacation in a hotel room right now, and many of my buyers are planning to turn their second homes into Airbnb rentals and earn some extra income when they’re not in town.”

Redfin noted the surging interest in vacation homes is indicative of the uneven financial recovery taking place throughout the country. Wealthy Americans are likely to have held onto their jobs—many with the freedom to work remotely—and they’re earning money through a robust stock market and rising real-estate values. But people in lower income brackets are more likely to work in industries such as restaurants, retail and hospitality that are still far from recovered.

“This recession has driven wealthy and low-income Americans further and further apart, and the soaring demand for vacation homes during the pandemic is a perfect example of their unequal financial footing, with some people buying second homes and others unable to buy their first,” said Redfin Chief Economist Daryl Fairweather. “Home prices just keep going up. That’s a good thing for Americans who already own one home because they can take advantage of their increased equity to buy other assets, which in some cases includes another home. But it’s bad for lower- and middle-class families, particularly those who are renters, because the barrier to homeownership is getting higher and higher.”

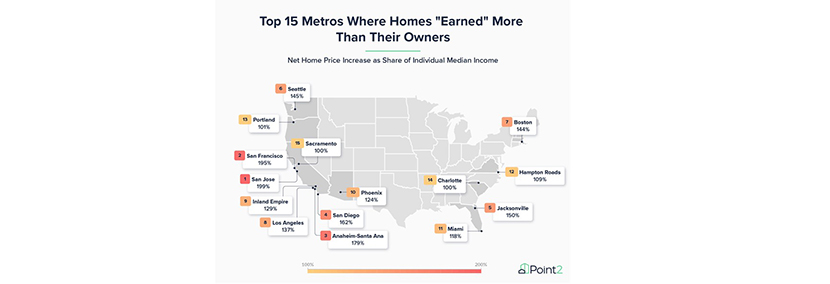

Point2Homes: Home Prices Outperform Earnings in 15 Major Markets

How much did homes “earn” compared to their owners’ income? In many parts of the country, said Point2Homes.com, more than their owners.

The Point2Homes analysis of America’s 50 largest metros found home prices reached historic highs after increasing 11.2% year-over-year — the largest annual gain in nearly 15 years. This means that home-owners in many U.S. metros saw the value of their home go up much faster than their salary, with single-family homes leading the way in price gains.

In the 15 most competitive markets, said Point2Homes.com, house price increases translated into net amounts larger than personal earnings. For example, the median salary in the San Jose metro area is a little more than $60,000, but home prices there increased by $120,000 in 2020. That means that the median single-family home “earned” almost twice as much as the median earner in the area.

As a percentage of earnings, in these same 15 metros home price increases represented between 100% and nearly 200% of median earnings, with the San Jose and San Francisco metros in the lead.

The report identified 27 medium-performing markets where home price gains in 2020 represented between 50% and 98% of individual local earnings. Nearly all of these metro areas recorded home price gains greater than $20,000 and $30,000 and, in the case of the New York metro, greater than $40,000.

At the other end of the spectrum, eight lower-performing markets have seen net home price increases that account for less than 50% of owners’ yearly individual earnings. In terms of net increases, seven of these metros recorded price jumps between just $15,000 and $18,600, with houses in Richmond, Va. houses adding less than $10,000 year over year.