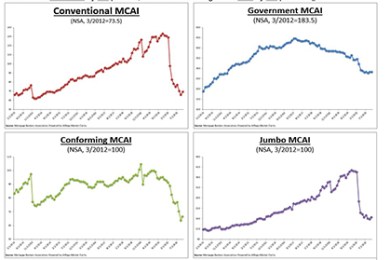

October Mortgage Credit Availability Shows Improvement

Mortgage credit availability increased in October after falling to a six-year low in September, the the Mortgage Bankers Association reported this morning.

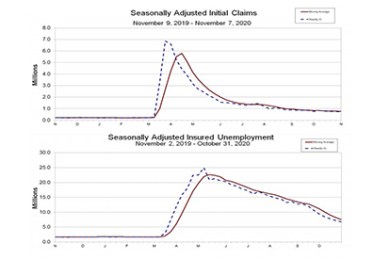

Initial Claims Drop, Remain Elevated

This week’s initial unemployment claims report from the Labor Department sounds an increasingly familiar theme: a slight drop from the previous week, tempered by the reality that claims remain highly elevated from pre-pandemic levels.

J.D. Power: Annual Satisfaction Study Reveals ‘Underlying Problems’ in Mortgage Industry

Record-low interest rates and low housing inventories have driven U.S. home sales to a 14-year high and yet another refinancing boom—the Mortgage Bankers Association now estimates 2020 mortgage originations to jump to $3.18 trillion—but it has also exposed underlying weaknesses in lender and servicer strategies, said J.D. Power, Troy, Mich.

TransUnion: Popularity of 15-, 20-Year Mortgages Continues to Grow

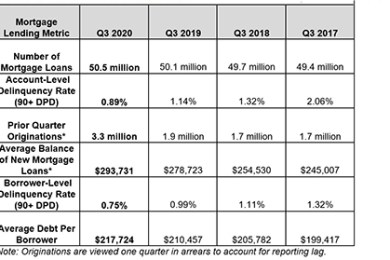

TransUnion, Chicago, said as low interest rates drive refinance activity, short-term loans—i.e., 15-year and 20-year mortgages—continue to increase in popularity, a trend that played out in the third quarter.

FHA Proposes Private Flood Insurance Option for Single-Family Mortgages

The Federal Housing Administration this week published a proposed rule to allow a private flood insurance option, instead of insurance through the National Flood Insurance Program, when flood insurance is required by FHA.