3Q Home Equity Levels Rise Despite Pandemic

ATTOM Data Solutions, Irvine, Calif., said equity-rich properties in the U.S. now outnumber those considered seriously underwater by a nearly 5-1 margin.

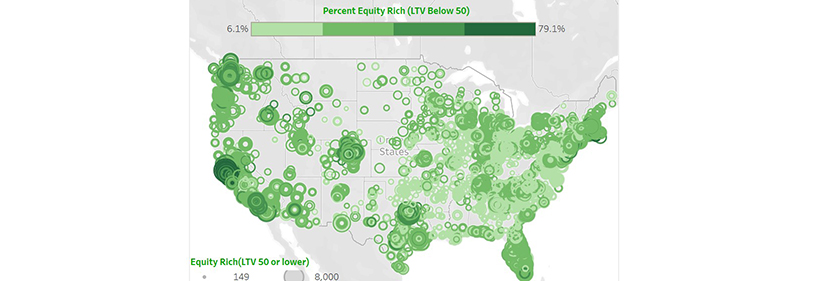

The company’s quarterly U.S. Home Equity & Underwater Report said 16.7 million residential properties are now considered equity-rich, representing 28 percent of the 58.9 million mortgaged homes in the United States. That level is up from 27.5 percent in the second quarter, 26.5 percent in the first quarter and 26.7 percent a year ago, despite the economic damage caused this year by the worldwide coronavirus pandemic.

The report also showed 3.5 million, or one in 17, mortgaged homes in the third quarter were considered seriously underwater, with a combined estimated balance of loans secured by the property of at least 25 percent more than the property’s estimated market value. That figure represents 6 percent of all U.S. properties with a mortgage, down from 6.2 percent in the prior quarter, 6.6 percent in the first quarter and 6.5 percent a year ago.

The report said 49 states showed a quarterly increase in the percentage of homes considered equity-rich, while just seven showed increases in the percentage that were seriously underwater. Six of the seven rose by less than one percentage point.

Todd Teta, chief product officer with ATTOM Data Solutions, said equity improved in the third quarter as the housing market around most of the country continued averting the slowdowns hampering other major sectors of the American economy during a time when the nation battles a virus pandemic that continues spreading. He said despite continued high unemployment, home values have remained on the rise throughout 2020, commonly by double-digit annual percentages.

“Homeowner equity in the third quarter added another pebble to the pile of markers showing that the U.S. housing market continues to defy the broad downturn in the economy this year,” Teta said. “Home prices keep rising, boosting the balance sheets of homeowners throughout most of the country. With the foundation under the housing market still shaky as the Coronavirus remains a threat, we will continue to monitor closely the various metrics, including equity. But as it’s been throughout the pandemic, the market is strong and homeowners remain in a position to benefit.”

Other report findings:

–Four of the 10 states with biggest gains in the share of equity-rich homes from the second quarter to the third quarter were in New England. The top five were Vermont, where the level of homes considered equity-rich rose from 39.1 percent in the second quarter of 2020 to 45.1 percent in the third quarter, Maine (up from 27.6 percent to 33.5 percent), South Dakota (up from 25.1 percent to 30.3 percent), New Hampshire (up from 22.6 percent to 26.7 percent) and Idaho (up from 35.4 percent to 39.5 percent).

–States where the share of equity-rich homes decreased or went up by the smallest amounts from the second to the third quarters included California (down from 43 percent to 39.7 percent), Maryland (up from 18.9 percent to 19.3 percent), Florida (up from 27 percent to 27.5 percent), Nevada (up from 28.2 percent to 28.8 percent) and Illinois (up from 15.6 percent to 16.2 percent).

–Eight of the 10 states with the biggest declines from the second to the third quarters in the percentage of homes considered seriously underwater were in the Midwest and South. They were led by Mississippi, (down from 15 percent to 12.6 percent), South Dakota (down from 11.1 percent to 8.8 percent), Indiana (down from 7.8 percent to 6 percent), Iowa (down from 13.9 percent to 12.1 percent) and Connecticut (down from 9.3 percent to 7.7 percent).

–Despite improvement in the Midwest and South, the Northeast and West again had far higher levels of equity in the third quarter than other areas of the United States. The top 11 states with the highest share of equity-rich properties in the third quarter were all in the Northeast and West, led by Vermont (45.1 percent), California (39.7 percent), Hawaii (39.6 percent), Washington (39.5 percent) and Idaho (39.5 percent).

–Among 107 metropolitan statistical areas with a population greater than 500,000, nine of the 10 with the highest shares of equity-rich properties again were in the West in the third quarter. They were led by San Jose (63.7 percent equity-rich); San Francisco (49.7 percent); Los Angeles (44 percent); Seattle (42 percent) and Boise, Idaho (40.4 percent). The leader in the Northeast region again was Boston, (38.4 percent), while Austin, Texas, led the South (37.5 percent) and Grand Rapids, Mich., continued to top the Midwest (30.7 percent).

–The top 15 states with the highest shares of mortgages that were seriously underwater in the third quarter were all in the South and Midwest, led again by Louisiana (15.3 percent seriously underwater), West Virginia (13.8 percent), Mississippi (12.6 percent), Iowa (12.1 percent) and Arkansas (11.7 percent). Among 107 metropolitan statistical areas with a population greater than 500,000, those with the highest shares of mortgages that were seriously underwater in the third quarter of 2020 were Baton Rouge, La. (14.5 percent); Youngstown, Ohio (14 percent); Syracuse, N.Y. (13.5 percent); Scranton, Pa. (13.1 percent) and Cleveland, Ohio (12.4 percent).