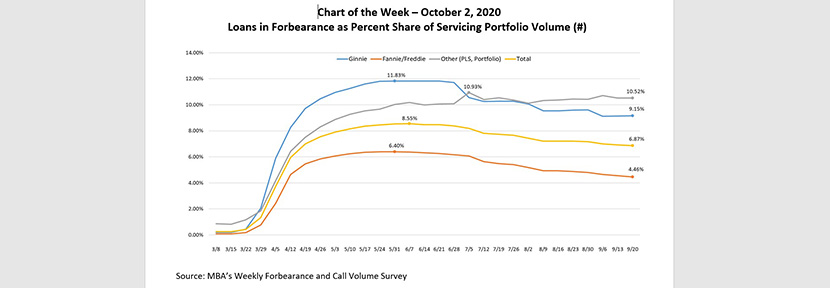

MBA Chart of the Week: Loans in Forbearance as Share of Servicing Portfolio Volume

According to the latest edition of MBA’s Weekly Forbearance and Call Volume Survey, released last week, the share of loans in forbearance dropped to 6.87 percent of servicers’ portfolio volume as of September 20. The share was the lowest point since mid-April, and 168 basis points below a peak of 8.55 percent during the week ending June 7.

Across all investor categories, forbearance rates have dropped from their peak levels, as employment conditions improved and more workers were brought back from temporary layoffs. The biggest driver in the overall forbearance rate decline has been in the share of Fannie Mae and Freddie Mac loans in forbearance, which has decreased for 16 straight weeks in a row to 4.46 percent (as of September 20). This is a 194-basis-point improvement over a peak of 6.40 percent as of May 31.

While also improving, the share of loans in forbearance for Ginnie Mae and portfolio loans and private-label securities remains elevated at levels over twice as high as Fannie Mae and Freddie Mac loans. The economic uncertainty of borrowers in these categories – particularly FHA and VA borrowers – may be preventing them from exiting forbearance through loan deferral, reinstatement, modification, loan payoff, repayment plan or other means.

Survey Note: Starting in July, our survey reveals a shift in the location of many FHA and VA loans, which were bought out of Ginnie Mae pools and moved onto servicer balance sheets. This explains the drop in the share of Ginnie Mae loans in forbearance, and offsets the increase in the share of portfolio loans in forbearance. The buyouts allow servicers to stop advancing principal and interest payments, and to work with borrowers to find solutions that could eventually result in re-securitizing the loans back into Ginnie Mae pools.

–Marina Walsh mwalsh@mba.org