Distressed Debt Monitor: A Conversation with Mayer Brown Partner Jeffrey O’Neale

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown’s Charlotte, N.C., office and a member of the Real Estate Markets practice, about hotel sector workouts and other distressed debt.

CREF Highlights Aug. 20, 2020

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

CMBS Market Musings by Andrew Foster

For better but more often for worse it seems lately, the commercial mortgage-backed securities market is continuing to experience interesting developments, whether it be updated credit rating agency analysis on evolving outlook, recent insights on the landscape from the special servicing community or the latest from bank research desks and MBA’s latest Quarterly CMF Originations Survey.

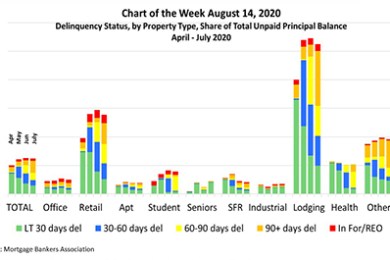

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans (2.8%) and slightly more than half of the balance of loans that had been less than 30-days delinquent in April moving to the 30-60 days delinquent category. The inflow of newly delinquent loans continued to slow in June (1.8% of overall balances) and July (1.4%).

Report Cites ‘Historic’ Drop in CRE Completions

Reis, New York, reported commercial real estate completions have declined “in a historic manner” since the pandemic and shutdown orders hit the U.S.

Dealmaker: Greystone Provides $100M in HUD-Insured Multifamily Financing

Greystone, New York, provided $100.3 million in HUD-insured loans for multifamily properties in California and Texas.

Personnel News from CBRE, Walker & Dunlop, Marcus & Millichap

CBRE, Los Angeles, announced Bill Grice joined CBRE Hotels as Executive Vice President and Co-Head of Hospitality Capital Markets. Based in the firm’s Atlanta office, he will focus on the origination and placement of debt and equity for hospitality-related transactions.

North American CRE Market Reacts to COVID Downturn

After a strong start to 2020, COVID-19’s impacts on North American commercial real estate hit during the second quarter, reported Transwestern, Houston, and Devencore, Toronto.

Pandemic Hits Single-Family Rent Prices

CoreLogic, Irvine, Calif., said single-family rent growth reached its slowest rate in a decade during June amid elevated unemployment rates.

Analysts Downgrade Hotel Outlook

Full recovery in U.S. hotel demand and room revenue remains unlikely until 2023 and 2024, respectively, said STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa. The firms slightly downgraded their hotel outlook report.