BREAKING NEWS

MBA Reports 2nd Quarter Delinquencies Jump; Loans in Forbearance Fall 9th Straight Week

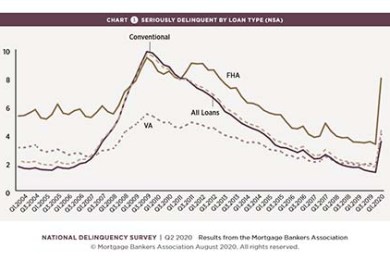

The Mortgage Bankers Association’s released its Second Quarter National Delinquency Survey, showing the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 8.22 percent of all loans outstanding.

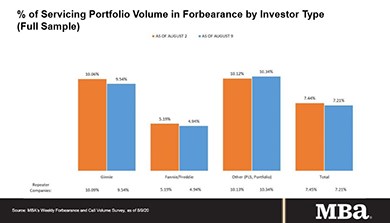

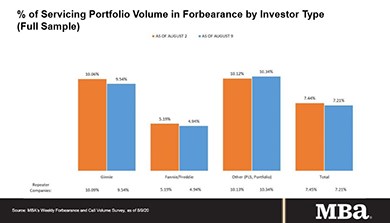

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 23 basis points to 7.21% of servicers’ portfolio volume the week of Aug. 9 from 7.44% the previous week. MBA estimates 3.6 million homeowners are in forbearance plans.

It’s been quite a year for the National Association of Home Builders/Wells Fargo Housing Market Index. In April, amid the worst of the coronavirus pandemic, the Index plunged 30 points to its lowest level since 2012. Yesterday—just four months later—the Index reached its highest point in its 35-year history.

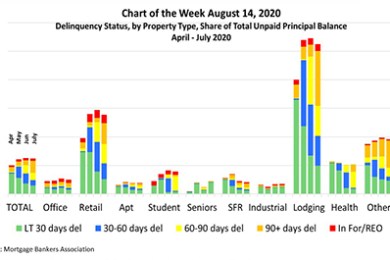

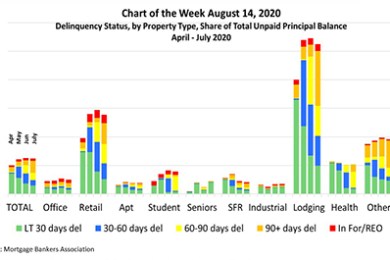

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.

For our 2020 Consumer Lending Survey eBook, we dive deep into the minds of consumers in the market for a loan in this socially distanced COVID-19 environment.

Reis, New York, reported commercial real estate completions have declined “in a historic manner” since the pandemic and shutdown orders hit the U.S.

Fannie Mae, Washington, D.C., said in the wake of the U.S. economy’s historic second-quarter contraction—nearly 40 percent—the strong rate of economic recovery seen in May and June sets up the third quarter for a “substantial rebound.”

As consumers make efforts to significantly limit in-person interaction, the demand for remote online notarization eClosings, which allow borrowers to join real estate closings from the comfort of and, more importantly, safety of their homes, has increased exponentially. This begs the question: Why isn’t everyone closing every loan with RON?

MBA NewsLink interviewed Jeffrey O’Neale, a partner in Mayer Brown's Charlotte office and a member of the Real Estate Markets practice. A primary focus of his practice is representing special servicers in loan workouts, restructurings and modifications and repurchase facility buyers in the servicing and administration of their commercial mortgage loan portfolios.

The leverage of all things digital is here. However, digitalization is NOT digital transformation, let alone digital leverage. As finance firms and their target markets reach their cycle peaks, the leverage of digital is a requirement most banking leaders have not incorporated into their forthcoming budgets and operations.

On Wednesday, the Federal Housing Finance Agency authorized Fannie Mae and Freddie Mac to impose an “Adverse Market Refinance Fee” – a 50-basis-point fee on most refinance mortgages, effective for loans delivered on or after September 1. Following the announcement, MBA CEO Bob Broeksmit, CMB, released a statement strongly urging FHFA to withdraw this directive.

VEREIT, Phoenix, and Ocean West Capital Partners LLC, El Segundo, Calif., acquired $654 million in industrial properties.