CRE Lending Eases as Underwriting Turns Conservative

CBRE, Los Angeles, said a temporary freeze in commercial real estate lending and transaction markets beginning in mid-March through early April led to fewer loan closings in the second quarter.

The CBRE Lending Momentum Index, which tracks the pace of U.S. commercial loan closings, fell to a value of 194 in June–a 29.3 percent decrease from its first-quarter close and down 20.5 percent from a year ago.

While the market saw better liquidity later in the quarter and multifamily agency and certain industrial deals were bright spots, other sectors suffered from selectivity and the withdrawal of commercial mortgage-backed securities and alternative sources of capital, the report said.

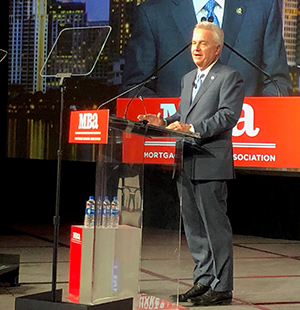

Speaking at MBA CREF 2020

“While we have seen a steady improvement in the number of loan applications over the past five weeks, we anticipate that commercial mortgage markets will remain muted over the near-term, especially for retail and hospitality properties, as well as value-added deals, which face the greatest underwriting challenges,” said 2020 Mortgage Bankers Association Chairman Brian Stoffers, CMB, who serves as Global President of Debt & Structured Finance for Capital Markets at CBRE.

Stoffers said underwriting will likely remain conservative due to current economic conditions and environmental challenges due to the pandemic.

CBRE said loan credit stress quickly emerged in the retail and hotel sectors during the pandemic lockdown, pushing the overall CMBS delinquency rate up to 6.37 percent in June from 1.24 percent in March. June delinquencies varied substantially by property type with hotel (22.82 percent) and retail (17.68 percent) leading, followed by office (2.43 percent), industrial (1.21 percent) and multifamily (0.6 percent).

CBRE’s lender survey found banks captured more than 70 percent of loan originations in the second quarter–more than double recent averages–mostly driven by regional bank activity. “With overall lending volumes down, banks were a source of refinance capital across all major property types and also funded several bridge and construction loans,” the report said.

Life companies accounted for the second-largest share of loan originations at 23 percent, down slightly from year-ago levels. Most life company originations were conservative, with loan-to-value ratios at 60 percent or less, CBRE said.

CMBS conduit lenders struggled to rebuild deal pipelines following the market disruption and the sharp rise in spreads during March and April, the report noted. In addition, loan underwriting remains challenging. Industry-wide CMBS issuance was close to $30 billion in H1 2020, the slowest pace since 2016.

Alternative lenders including debt funds, mortgage real estate investment trusts and finance companies were largely absent from second-quarter loan fundings because several experienced liquidity issues, the report said.

Loan underwriting measures changed modestly during the quarter. The average LTV ratio fell while the average debt service coverage ratio and debt yield rose. The average amortization rate fell, reflecting a higher percentage of loans carrying either partial-or full-term interest-only, more than 67 percent compared to less than 60 percent a year ago.

“The changes in loan underwriting measures reflected the underlying property type composition,” Stoffers said. “While both multifamily and commercial underwriting was more conservative, the overall results were affected by a higher proportion of multifamily loans, which tend to be underwritten slightly more aggressively than commercial ones.”