ANNOUNCEMENT

Offices of the Mortgage Bankers Association are closed today in observance of Juneteenth. MBA offices will re-open on Monday, June 22.

Sen. Deb Fischer, R-Neb., reintroduced legislation this week that would change the structure of the Consumer Financial Protection Bureau from a single director to a bipartisan commission of five individuals.

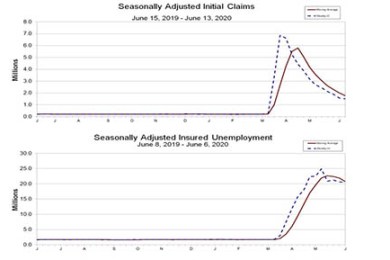

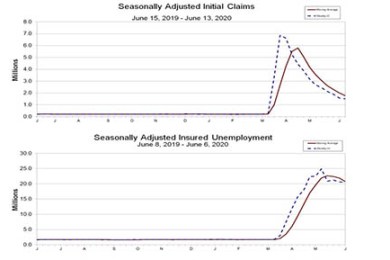

More than 1.5 million Americans filed initial claims for unemployment insurance last week virtually unchanged from the previous week and at historically elevated levels for the 12th consecutive week, the Labor Department reported yesterday.

Zillow, Seattle, said the housing market’s resilience in the wake of the coronavirus pandemic and resulting economic downturn could be challenged in the months ahead as continued slowing in home values suggest prices could fall in the second half of 2020.

Reonomy, New York, said retail properties are being recycled and repurposed due to COVID-19 as retailers redefine the sales channels they use to reach consumers.

Zillow, Seattle, said the housing market’s resilience in the wake of the coronavirus pandemic and resulting economic downturn could be challenged in the months ahead as continued slowing in home values suggest prices could fall in the second half of 2020.

NAMMBA hosts a special state of the industry town hall series, The COLOR of COVID, this Friday, June 19, from 1:00-4:00 p.m. ET.

In a time when everything spells uncertainty, data gives lenders something to hold on to — and a path forward. What performance metrics are most critical for lenders to keep an eye on right now to help their businesses survive the recession and what’s likely to be a protracted recovery?

There is no downplaying the destruction the COVID-19 pandemic has had on our economy and the financial lives of millions of Americans. But it is also threatening the up-and-coming generation of home buyers, particularly minorities.

June is Homeownership Month in a year unlike any other. MBA NewsLink asked executives of four lenders to discuss how the coronavirus has affected their business and what they are doing to adapt and succeed.

David Upbin is Vice President of Education Operations and Programming & MBA Strategy with the Mortgage Bankers Association. He joined MBA in 2013 and is responsible for financial management, operations, delivery and programming of MBA Education's suite of training products and events.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

Greystone, New York, provided $124.3 million in in Fannie Mae Delegated Underwriting and Servicing loans to refinance five multifamily properties.