Unemployment Claims Plateau, Remain Elevated

More than 1.5 million Americans filed initial claims for unemployment insurance last week virtually unchanged from the previous week and at historically elevated levels for the 12th consecutive week, the Labor Department reported yesterday.

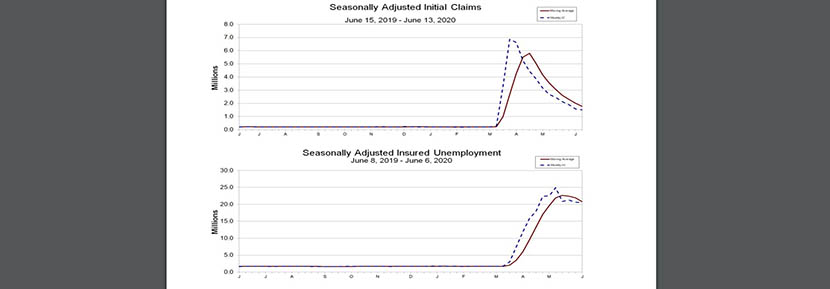

The report said for the week ending June 13, the advance figure for seasonally adjusted initial claims fell slightly to 1.508 million, a decrease of 58,000 from the previous week’s revised level. The four-week moving average fell to 1.774 million, a decrease of 234,500 from the previous week’s revised average.

Labor said the advance seasonally adjusted insured unemployment rate was unchanged at 14.1 percent for the week ending June 6. The advance number for seasonally adjusted insured unemployment—also known as “continuing claims”—during the week ending June 6 fell to 20.54 million, a decrease of 62,000 from the previous week’s revised level. The four-week moving average fell to 20.81 million, a decrease of 1.092 million from the previous week’s revised average.

The report said people claiming benefits in all programs for the week ending May 30 totaled 29.14 million, a decrease of 375,522 from the previous week. A year ago, just 1.56 million people claimed benefits in all programs.

Since February, nearly 46 million unemployment insurance claims have been filed.

Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said the leveling off likely reflected moderation in the pace of re-openings across the country. “Jobless claims did not do a good job of anticipating May’s surprisingly large jump in nonfarm payrolls,” he said. “Rehiring from temporary layoffs likely differs greatly from cyclical layoffs.”

“While the initial claims figure has trended downward for 11 consecutive weeks from its peak of 6.9 million on March 28, this number still remains at historically elevated levels and continues to illustrate the unprecedented degree of labor market disruption being registered via reduced economic activity and consumer confidence due to the ongoing COVID-19 outbreak,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C.