Zillow, Seattle, said 464 cities in the U.S. have typical home values of $1 million or more. That’s way down from last July, when 522 cities hit the mark.

Tag: Zillow

Zillow: Homes Owned by Black Families Appreciated Fastest During Pandemic

Homes owned by Black families appreciated more than any others since the start of the pandemic, with the typical Black homeowner gaining nearly $84,000 in equity, reported Zillow, Seattle.

Homebuyers, Sellers Have Plenty of Market Misconceptions

Amid a volatile and rapidly changing housing market, many homebuyers and home sellers have unrealistic expectations about their prospects, according to a Zillow survey of real estate agents.

Analysis: Flood Risks Having Growing Influence on Home Buyers

Zillow, Seattle, in partnership with ClimateCheck, reported areas with increased flood risk also see an increase in mortgage denials and in would-be borrowers withdrawing their mortgage applications, even after controlling for income and property value.

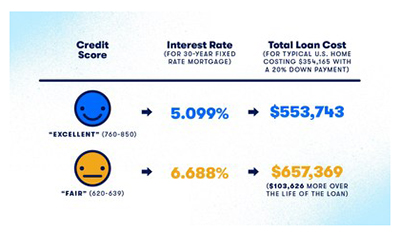

Zillow: Lower Credit Score Homebuyers Pay $104,000 More in Mortgage Costs

Elevated home prices and rising interest rates are feeding into housing affordability woes for potential buyers–especially those with lower credit scores–reported Zillow, Seattle.

Home-Selling: It’s in the Metrics

Can algorithms determine the perfect time to list a home in today’s market? And in today’s market, does it even matter? Zillow, Seattle, thinks so.

Housing Market Roundup: Apr. 5, 2022

Here’s a summary of recent housing market and economic reports that came across the MBA NewsLink desk:

Million-Dollar Cities Club Gets 146 New Members

Zillow, Seattle, reported a record 146 U.S. metros became new “million-dollar cities” in 2021, making 481 cities in which the typical home value is at least $1 million.

Despite Record Low Rates, Most Homeowners Pass on Refinancing

A Zillow survey of more than 1,300 homeowners found despite record low interest rates, more than three-fourths of respondents passed up the opportunity to refinance their mortgage.

Pandemic Year Brings Huge Surge in ‘Million-Dollar Cities’

Move over, San Francisco Bay Area and New York City; you’ve got company—lots of it.