MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the Department of Veterans Affairs’ (VA) reported plans of a phase-out of its Veterans Affairs Servicing Purchase (VASP) program.

Tag: VA

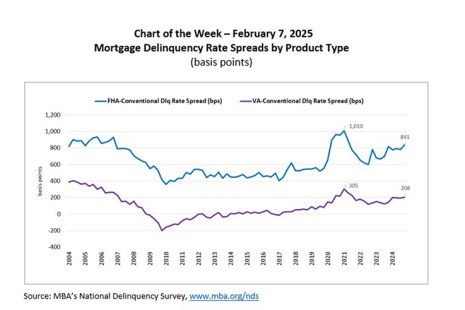

Chart of the Week: Mortgage Delinquency Rate Spreads by Product Type

According to the latest results from MBA’s National Delinquency Survey (NDS), the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to a seasonally adjusted rate of 3.98 percent of all loans outstanding at the end of the fourth quarter of 2024.

To the Point With Bob–Mortgage Servicers: Diligently Serving Borrowers Through Constant Change

Mortgage servicers have a vital function in the mortgage market and the wider economy, writes MBA President and CEO Bob Broeksmit, CMB.

Biden Administration Extends, Expands Forbearance/Foreclosure Relief Programs

The Biden Administration yesterday announced a coordinated extension and expansion of forbearance and foreclosure relief programs. The programs, set to expire at the end of March, have now been extended through June 30.

California County Ends Controversial PACE Loan Program

Forget the coronavirus—if you want to raise the blood pressure of a mortgage lender or servicer, just say these two words: “PACE loan.”

ATTOM: 4Q Refinances More than Double

ATTOM Data Solutions, Irvine, Calif., reported 1.27 million refinance mortgages secured by residential property originated in the fourth quarter, up 20 percent from the third quarter and up by 104 percent from a year ago to the highest point since third quarter 2013.

#MBAServicing2020: MBA Releases Default Servicing Alignment White Paper

ORLANDO—The Mortgage Bankers Association released a white paper that analyzes federal foreclosure prevention programs and offers recommendations to better align and standardize those programs.

#MBAServicing2020: MBA Releases Default Servicing Alignment White Paper

ORLANDO—The Mortgage Bankers Association released a white paper that analyzes federal foreclosure prevention programs and offers recommendations to better align and standardize those programs.