The credit card industry is rebounding strongly from the early impacts of the COVID-19 pandemic, said TransUnion, Chicago, with Gen Z leading the way in terms of originations and bankcard balance growth and other credit categories, including mortgage.

Tag: TransUnion

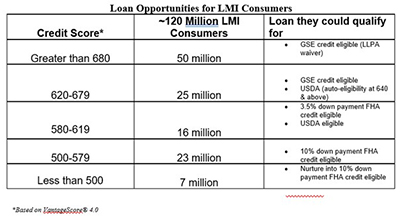

TransUnion: LMI Consumers Present $300 Billion Growth Opportunity for Mortgage Industry

Low-to-moderate income consumers have traditionally been overlooked in the mortgage market and trail non-LMI consumers in terms of homeownership. A new study from TransUnion, Chicago, suggests closing this gap could yield mortgage lenders as much as ~$300 billion in refinance and purchase originations.

TransUnion: Majority of Consumers in Accommodation Programs Continue to Make Payments

Enrollment in financial hardship programs grew significantly as a result of the COVID-19 pandemic – to 7% of all accounts for credit products such as auto loans and mortgages. However, a new TransUnion study reported the majority of consumers continued to make payments on their accounts, even when in an accommodation program.

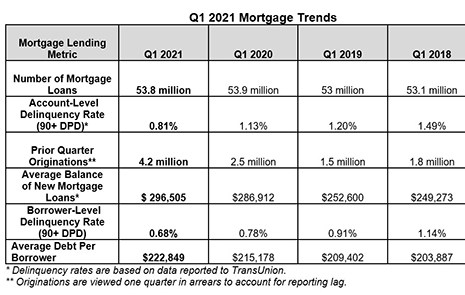

TransUnion: Consumer Credit Performance Improving, Demand Increasing

TransUnion, Chicago, said despite shockwaves felt from the COVID-19 pandemic, the consumer credit market is strongly positioned as many parts of the country prepare to enter new phases of re-opening this summer.

Positive Signs Even as Many Household Incomes Still Negatively Impacted by COVID-19

U.S. consumers continue to be negatively impacted one year since the onset of COVID-19, although TransUnion, Chicago, reported positive signs in its latest Consumer Pulse study.

TransUnion: Percentage of Consumers with Financial Accommodations Remains Elevated

TransUnion, Chicago, said its latest Financial Services Monthly Industry Snapshot Report shows 2.87% of accounts in the auto, credit card, mortgage or unsecured personal loan industries remained in some form of financial hardship status at the end of December.

Consumers Resilient Despite Broader Economic Challenges

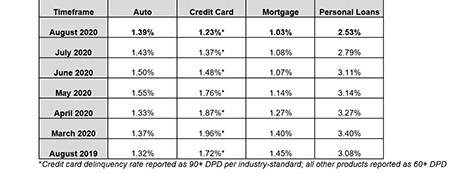

Serious delinquency rates in August improved once more across all consumer credit segments even as the number of people in accommodation programs dropped for the second consecutive month, reported TransUnion, Chicago.

TransUnion: Consumer Credit Market Withstands Coronavirus Challenges

TransUnion, Chicago, reported the total percentage of accounts in “financial hardship” status dropped during July for mortgages, auto loans, credit cards and personal loans – marking the first such decrease since the start of the COVID-19 pandemic.

Gen Z Displays Strong Appetite for Credit; Millennials Refinance Less (For Now)

TransUnion, Chicago, said Generation Z consumers—those born in or after 1995—are actively seeking credit despite many of them growing up during severe economic recessions in their respective global markets.

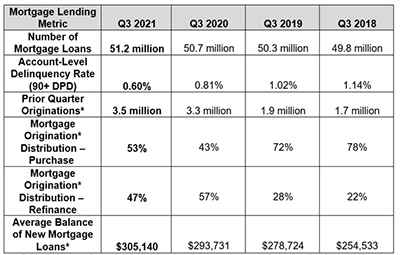

Consumers Poised for Continued Strong Credit Activity

TransUnion, Chicago, said its quarterly Industry Insights Report points to several factors that portend good things for retailers this holiday season.