The consumer credit market remains resilient in the face of a challenging economic environment, according to TransUnion, Chicago.

Tag: TransUnion

TransUnion: Mortgage Originations Down Almost 37% in Third Quarter Amid Higher Credit Balances

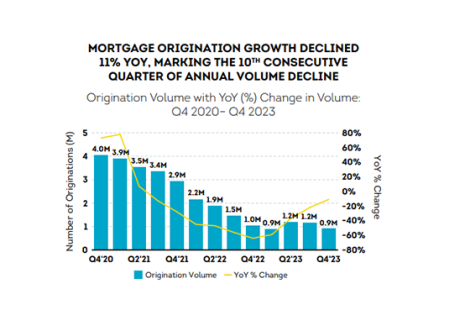

TransUnion, Chicago, Ill., released its Q3 2023 Quarterly Credit Industry Insights Report, finding higher interest rates and prices for goods have pushed credit balances up. Simultaneously, mortgage originations–and other new credit accounts such as automobile loans–are lagging last year.

TransUnion: Mortgage Balances Remain Near Record Highs; More Consumers Turn to Home Equity Loans

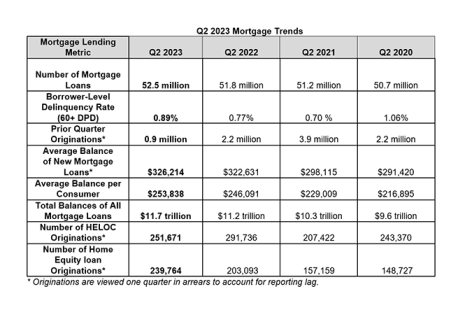

TransUnion, Chicago, said total mortgage balances fell to $11.7 trillion in the second quarter, down slightly from last quarter’s record high but up 4.3% year-over-year.

CFPB: Annual Report on Credit Reporting Companies Cites ‘Ongoing Challenges’

The Consumer Financial Protection Bureau on Tuesday issued its annual report on the industry’s three largest credit reporting companies, based on nearly a half-million complaints it received about TransUnion, Equifax and Experian.

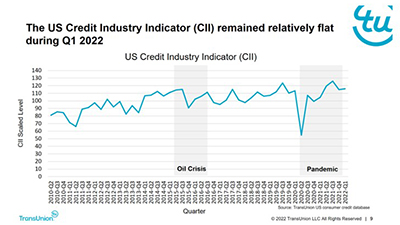

Despite Challenges, 1Q Consumer Credit Health Stays Strong

Rising interest rates and increased prices of goods and services placed pressure on the consumer wallet in the first quarter. Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to the Quarterly Credit Industry Insights Report from TransUnion, Chicago.

Millennials’ Late Homeownership, Increased Migration Impact Insurance Carriers

Seemingly little things can have big consequences. For the insurance industry, said TransUnion, Chicago, the delay in Millennial homeownership has had ripple effects that insurance providers are feeling now.

Rising Inflation Impacting Non-Prime Borrowers Most

As rapidly rising gasoline, energy and utility prices drive inflation, non-prime borrowers with the riskiest credit profiles have generally experienced the greatest impact to their wallets, reported TransUnion, Chicago.

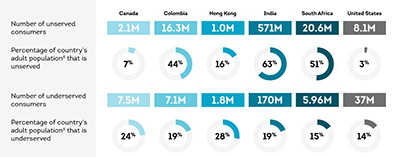

TransUnion: More than 45 Million Americans Credit Unserved or Underserved

More than 45 million consumers are considered to be either credit unserved or underserved in the United States, according to a new global TransUnion study

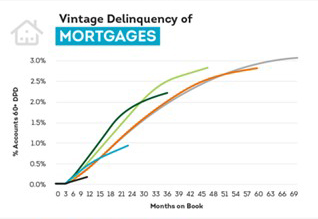

TransUnion: Recent Vintage Loans Perform Well Even as More Non-Prime Consumers Gain Credit

TransUnion, Chicago, said consumer credit performance maintained healthy levels across auto, credit card, personal loans and mortgages in the fourth quarter even as lenders continued to ramp up new account origination growth in the non-prime segment of the market.

CFPB Analysis Criticizes Consumer Reporting Companies on Complaint Response

A new Consumer Financial Protection Bureau analysis sharply criticized the three major nationwide consumer reporting companies, alleging changes in complaint responses provided by Equifax, Experian and TransUnion resulted in fewer meaningful responses and less consumer relief.