TransUnion, Chicago, released its 2026 Consumer Credit Forecast, predicting that mortgage delinquencies in the 60-plus days past due category will increase slightly by the end of next year.

Tag: TransUnion

TransUnion: Mortgage Originations, Delinquencies Both Rise

TransUnion, Chicago, released its Q3 Credit Industry Insights Report, finding that mortgage originations grew 8.8% year-over-year in Q2.

Transunion: Total Tappable Home Equity Remains High

Transunion, Chicago, released its Q2 Home Equity Report, finding that total tappable home equity stands at $21.5 trillion, up 5% year-over-year.

TransUnion Finds Correlation Between PTI Ratios, Mortgage Delinquencies

TransUnion, Chicago, released a new analysis finding a correlation between rising payment-to-income ratios and rising mortgage delinquencies.

TransUnion: Mortgage Originations, Delinquencies Both Up

TransUnion, Chicago, released its Q1 2025 Credit Industry Insights Report, finding that mortgage originations saw an annual increase at the end of last year.

TransUnion Predicts Increase in Mortgage Originations This Year

TransUnion, Chicago, released its Q4 2024 Quarterly Credit Industry Insights Report, predicting multiple credit products will see growth this year.

TransUnion Predicts Mortgage Delinquencies Will Be Flat

TransUnion, Chicago, released its forecast for 2025, predicting that mortgage delinquencies will be flat a year from now in Q4 2025.

TransUnion: Mortgage Delinquencies Tick Up but Remain Low

TransUnion, Chicago, released its Q3 2024 Credit Industry Insights Report, finding that mortgage delinquencies have slowly begun to increase among consumers.

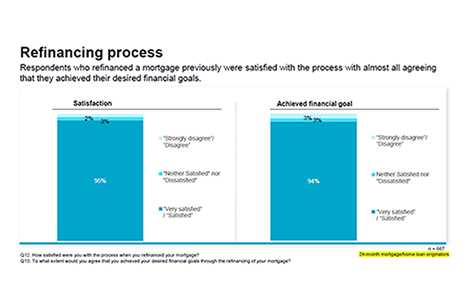

TransUnion: Four in Five Homeowners Say Their Mortgage Payments Strain Their Finances

A new survey from TransUnion, Chicago, found that many consumers feel their mortgage payments are putting a strain on their household finances, and the prospect of falling interest rates has them ready to consider refinancing those loans.

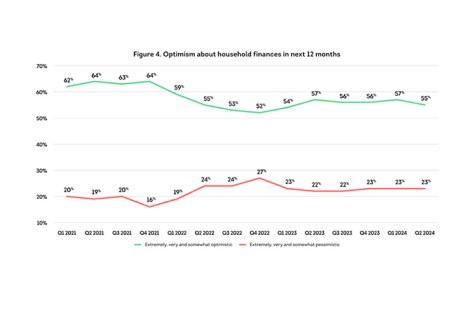

TransUnion: Consumer Outlook Mixed in Q2

TransUnion, Chicago, released its Consumer Pulse Study for the second quarter, finding consumer concerns about inflation and interest rates have hit their highest levels in two years.