Nearly two-thirds of regulatory compliance professionals say technology-driven risk is the most significant market force likely to cause compliance issues for financial services firms, according to eflow Global, Boston.

Tag: Technology

MBA Premier Member Editorial: Tech and AI Are Advancing, So What’s Next for Mortgage Pricing?

Today, conversations around mortgage pricing tend to focus on AI and modern technology, yet there was a time when everything was handled very differently – before the first product, pricing, and eligibility engine was even introduced, Optimal Blue’s Mike Vough writes.

Freddie Mac’s Mike Hutchins Announces LPA Update; Talks Tech, Repurchases With Fannie Mae’s Priscilla Almodovar

DENVER–Freddie Mac President Mike Hutchins announced Oct. 28 the latest addition to the enterprise’s automated underwriting system (Loan Product Advisor): LPA Choice.

Navigating the Future: Lender Price’s Dawar Alimi on Technology Trends in the Mortgage Industry

In today’s rapidly evolving landscape, technology plays a pivotal role in reshaping industries, and the mortgage sector is no exception.

Call for Nominations: MBA NewsLink 2024 Tech All-Star Awards

The MBA NewsLink 2024 Tech All-Star Awards nomination period is underway.

Souren Sarkar, CMB, of Nexval: What Recent Flight Fiascos Can Teach Us About Investing in Technology

If mortgage servicers ever needed an argument to not hold back on technology investments, they need look no further than the recent fiascos in the airline industry.

The World is Changing: is Real Estate Ready?

It’s safe to say 2020 has been one “hold my beer” moment after another. And the real estate finance industry, says States Title, San Francisco, had better be prepared for more changes—or risk obsolescence.

John Walsh: Tax Service – A New Era

For decades, tax service has gone unchanged. There are many efforts to change this dynamic; layering in new technology for servicers to engage with their tax vendor and improving transparency in a historically monochromatic space.

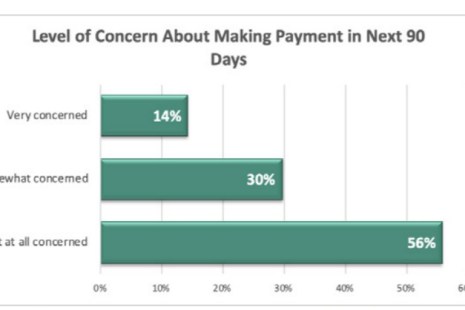

STRATMOR Study Lays Bare Uncertainties of COVID-19 Impact on Housing Market

A study by STRATMOR Group, Greenwood Village, Colo., shows just how quickly and hard-hitting the coronavirus pandemic has been on homeowners.

Paul Fischer of Paradatec on What Mortgage Servicers Can Expect in Months Ahead

Paul Fischer is Director of Professional Services with Paradatec, Cincinnati.