U.S. insurers and homeowners face greater risks and higher costs as extreme weather events including hurricanes, wildfires and floods become more frequent and intense, according to S&P Global Ratings, New York.

Tag: S&P Global Ratings

S&P Global Ratings: Large Banks Likely to See Stable Financial Performance Amid Headwinds

Earnings at most of the eight U.S. global systemically important banks improved from the same quarter last year, largely because of higher net interest income, reported S&P Global Ratings, New York.

S&P Global Ratings: Selective Defaults Increase

Selective defaults have increased in recent years, which can create a “slippery slope” to future defaults, reported S&P Global Ratings, New York.

CMBS Delinquency Rate Shrinks, Cumulative Default Rate Increases

The commercial mortgage-backed securities delinquency rate continues to shrink, but the cumulative loan default rate increased slightly in first-half 2021, according to two new reports from S&P Global Ratings and Fitch Ratings.

Real Estate Investment Trusts Poised For Recovery

S&P Global Ratings, New York, said real estate investment trust earnings rebounded significantly in the second quarter, demonstrating the sector is on the right path for a solid comeback.

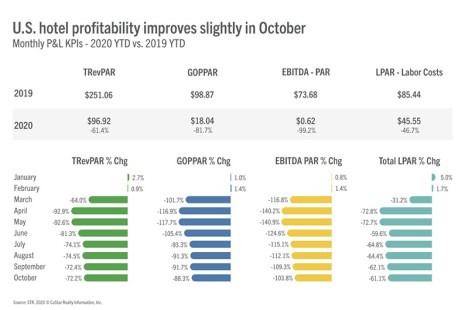

Hotel Sector Recovery Slows

The hotel sector recovery has slowed in recent months after rebounding in the fall from April lows, said Fitch Ratings, New York.

CMBS Delinquency Rate Falls; Issuance Bounces Back

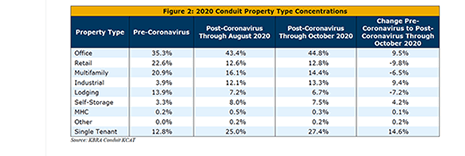

The commercial mortgage-backed securities delinquency rate continued to fall in October while issuance increased, said Trepp LLC and KBRA, New York.

CMBS Servicers Working through Surge in Requests

S&P Global Ratings, New York, said commercial mortgage-backed securities special servicers are working through a surge in borrower requests for relief, primarily on lodging and retail properties.

S&P: Retail REITs Could Face Distress Until At Least 2021

S&P Global Ratings, New York, said retail real estate investment trusts, already buffeted by the coronavirus pandemic and dwindling brick-and-mortar revenues, could see an increase in downgrades in coming quarters with little chance of recovery before next year.

Andrew Foster: Preferred Equity Plan for Commercial Real Estate Comes to Washington

Here in Washington, ongoing COVID-19 relief discussions have reached the commercial real estate borrowing community and their financiers in earnest.