The Federal Housing Finance Agency on Thursday re-proposed minimum financial eligibility requirements for Fannie Mae and Freddie Mac seller/servicers.

Tag: Robert Broeksmit CMB

FHFA Targets Increases to GSE Pricing Framework; Upfront Loan-Level Pricing Adjustments Take Effect Apr. 1

The Federal Housing Finance Agency on Wednesday announced targeted increases to Fannie Mae and Freddie Mac’s upfront fees for certain high-balance loans and second-home loans, effective Apr. 1.

Senate Approves Alanna McCargo as Ginnie Mae President

The Senate on Tuesday approved Alanna McCargo as President of Ginnie Mae by voice vote.

Biden Nominates Sandra Thompson as FHFA Director

President Joe Biden on Tuesday announced his intent to nominate Sandra Thompson as Director of the Federal Housing Finance Agency, an appointment long-supported by the Mortgage Bankers Association.

MBA Commends HUD Guidance on Special Purpose Credit Programs

HUD on Dec. 7 released guidance clarifying special purpose credit programs that conform with the Equal Credit Opportunity Act and Regulation B generally do not violate the Federal Fair Housing Act.

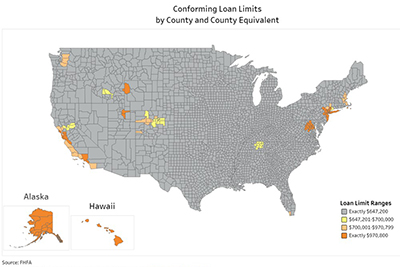

2022 GSE Conforming Loan Limits Rise 18.5% to $647,200

Conforming loan limits for Fannie Mae and Freddie Mac will rise to $647,200 jump in 2022, the Federal Housing Finance Agency said Nov. 30—a jump of nearly $100,000 from 2021’s previous record high.

MBA Letter Offers Recommendations to FHFA Proposed Regulatory Capital Framework

The Mortgage Bankers Association, in a Nov. 23 letter to the Federal Housing Finance Agency, offered a series of recommendations to improve a proposed regulatory capital framework rule for Fannie Mae and Freddie Mac.

To the Point with Bob: Servicers are Helping Borrowers Through the Pandemic

Policymakers have gone to great lengths to provide servicers and borrowers the tools they need to bring about a successful resolution in the vast majority of cases. I hope that policymakers will continue to allow servicers to do what they do best – help their customers.

FHA Actuarial Report: Capital Ratio Grows to 8.03%; HECM Ratio Positive for First Time Since 2015

HUD on Monday released its fiscal year 2021 report to Congress on the financial health of the Federal Housing Administration Mutual Mortgage Insurance Fund, showing a nearly 2 percent increase in the fund’s capital ratio to more than 8 percent, well above its congressionally mandated minimum of 2 percent.

‘Together Again’—and Not a Moment Too Soon

SAN DIEGO—For the first time in two years, the Mortgage Bankers Association is holding a live Annual Convention & Expo. And MBA President & CEO Bob Broeksmit, CMB, had a message for the nearly 3,500 in attendance.