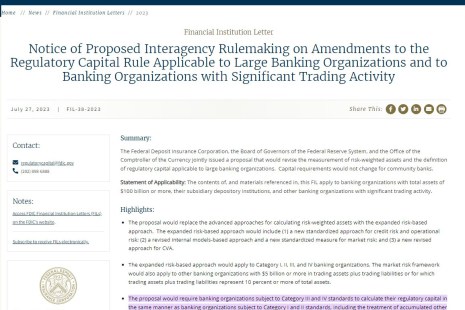

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. MBA strongly opposes certain provisions of the proposal.

Tag: Robert Broeksmit CMB

To the Point with Bob: Regulators: Take Steps to Recognize Warehouse Lenders’ Important Role in Today’s Housing Finance Market

This is a difficult time for the housing industry, and those challenges extend to all corners—not only mortgage lenders but also the warehouse lenders, vendors, title companies, and real estate agents that support the housing and mortgage finance ecosystem.

MBA Comments on HUD COVID-Related Loss Mitigation Report

The HUD Office of the Inspector General issued two audit reports Thursday examining the loss mitigation options that loan servicers provided to borrowers with FHA-insured loans after their COVID-19 forbearance ended.

Quote: Tuesday, June 20, 2023

“Since the pandemic began in March 2020, mortgage servicers provided payment relief to nearly 8 million borrowers via forbearance. Today, only approximately 255,000 borrowers remain in forbearance, and delinquency rates are near historic lows.” –Mortgage Bankers Association President and CEO Bob Broeksmit, CMB.

#MBASecondary23: Broeksmit: ‘You Don’t Need Punishment or More Regulation; You Need Praise and Relief—and You Need it Now’

NEW YORK—When Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, stepped on stage Monday here at the National Secondary Market Conference & Expo, he promised a presentation “more pugnacious than normal.” And he delivered.

FHFA Rescinds Proposed Loan-Level Pricing Adjustment for DTI Ratios

The Federal Housing Finance Agency on Wednesday rescinded a controversial proposed loan-level pricing adjustment that the Mortgage Bankers Association said would have had adverse impact on both consumers and lenders.

MBA Amicus Brief: Lenders Not Liable for Actions of Independent Appraisers

The Mortgage Bankers Association on Friday filed an amicus brief in litigation in response to a statement of interest filed by the Consumer Financial Protection Bureau and Department of Justice examining the liability standard that would apply to lenders for the acts of independent, third-party appraisers.

CFPB Releases Final Rule on Small Business Loan Reporting

The Consumer Financial Protection Bureau on Thursday issued a final rule that would require some lenders to collect and report information about small business credit applications they receive, including geographic/demographic data, lending decisions and the price of credit.

National Council of State Housing Finance Agencies Announces Affordable Homeownership Lender Toolkit

The National Council of State Housing Finance Agencies, with support from the Mortgage Bankers Association and other industry trade groups, announced availability of the HFA1 Affordable Homeownership Lender Toolkit, a new online resource that will enable home mortgage lenders to partner more efficiently with state housing finance agencies in providing mortgage loans and down payment assistance to lower-income home buyers.

MBA President and CEO Bob Broeksmit, CMB, on Recent Coverage of Uncertainty in Commercial Real Estate Markets

Bob Broeksmit, CMB, President and CEO of the Mortgage Bankers Association, issued the following statement on recent coverage of uncertainty in commercial real estate markets: