The first letter offers recommendations on how FHFA can improve its framework for codifying new liquidity requirements for Fannie Mae and Freddie Mac. The second letter addresses an FHFA proposal to require Fannie and Freddie to develop and maintain “living wills” in the event one or both of them becomes insolvent.

Tag: Robert Broeksmit CMB

MBA Letter to FHFA Offers Recommendations on Appraisal Policies

The Mortgage Bankers Association, in a Feb. 26 letter to the Federal Housing Finance Agency, offered a set of recommendations aimed at promoting and modernizing the appraisal process.

FHFA Extends COVID-19 Forbearance Period/Foreclosure and REO Eviction Moratoriums; Aligns Mortgage Relief Policies Across Government

The Federal Housing Finance Agency on Thursday announced extensions of several measures to align COVID-19 mortgage relief policies across the federal government, a move that drew praise from the Mortgage Bankers Association.

Biden Administration Extends, Expands Forbearance/Foreclosure Relief Programs

The Biden Administration yesterday announced a coordinated extension and expansion of forbearance and foreclosure relief programs. The programs, set to expire at the end of March, have now been extended through June 30.

MBA Letter Offers Support for Yellen Treasury Nomination

Janet Yellen, President-Elect Joseph Biden Jr.’s nominee for Treasury Secretary, appears this morning for a confirmation hearing before the Senate Finance Committee. Ahead of the hearing, the Mortgage Bankers Association sent a letter in support of her nomination.

FHFA Amends GSE Stock Purchase Agreements; Leaves Decision on Conservatorship to Biden Administration

Fannie Mae and Freddie Mac will not exit federal conservatorship under the Trump Administration; the Federal Housing Finance Agency will leave that decision to the Biden Administration, FHFA said Thursday.

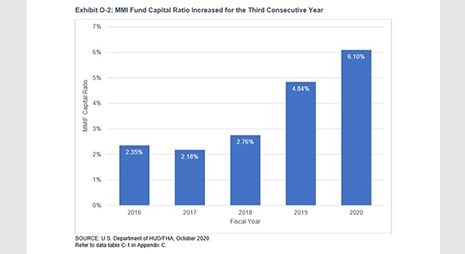

FHA 2020 Actuarial Report: MMI Fund Capital Ratio at 13-Year High

The Federal Housing Administration om Friday said its Mutual Mortgage Insurance Fund capital ratio ended fiscal year 2020 at 6.1 percent, well above its congressionally mandated 2.0 percent capital ratio to its highest level since 2007.

‘Not Ok? That’s Ok:’ Financial Services, Consumer Coalition Launches Borrower Awareness Campaign

The Mortgage Bankers Association and a broad coalition of financial services stakeholders – including mortgage servicers, trade associations, housing counseling agencies, governmental agencies and think tanks – launched a consumer awareness campaign to reach borrowers who have missed one or more mortgage payments as a result of the COVID-19 pandemic and may be eligible for forbearance assistance under the CARES Act or other forms of mortgage payment relief.

Broeksmit: ‘MBA Was Made for Times of Crisis’

In remarks yesterday during the Mortgage Bankers Association’s virtual Regulatory Compliance Conference, MBA President & CEO Robert Broeksmit, CMB, said the extraordinary events of 2020 have tested everyone’s mettle—including that of MBA.

MBA Offers FHFA Recommendations on GSE Strategic Plan

The Mortgage Bankers Association, in comments yesterday to the Federal Housing Finance Agency, said the FHFA Strategic Plan for fiscal years 2021-2024 should continue to work toward an ultimate goal: releasing Fannie Mae and Freddie Mac from federal conservatorship—but only when they are able to do so without risk to the real estate finance markets.