The Mortgage Bankers Association nominated Mark Jones, CEO and Co-Founder of Amerifirst Home Mortgage, Kalamazoo, Mich. to serve as its Vice Chairman for the 2022 membership year.

Tag: Robert Broeksmit CMB

CFPB Formally Delays QM Final Rule Compliance Date to Oct. 2022

The Consumer Financial Protection Bureau yesterday formally delayed the mandatory compliance date of its General Qualified Mortgage final rule to October 1, 2022.

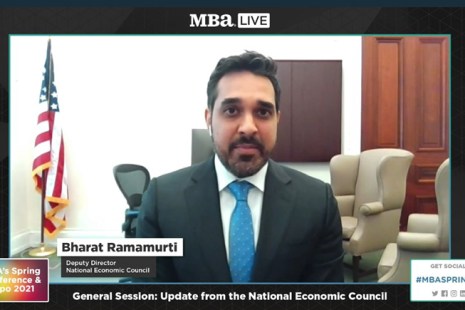

#MBASpring21: Administration Acknowledges Issues with GSE Product Caps

During the final months of the Trump Administration, the Federal Housing Finance Agency implemented product caps on Fannie Mae and Freddie Mac through their Senior Preferred Stock Purchase Agreements—a move that the Mortgage Bankers Association called “disruptive” for many of its members.

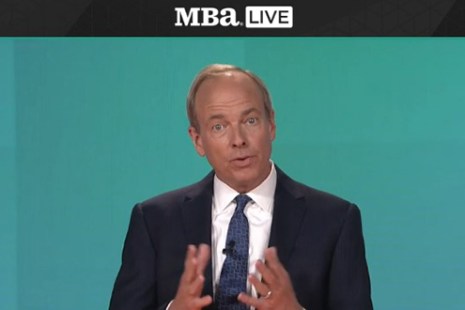

#MBASPRING21 Broeksmit: Industry Faces ‘Different Landscape’ in 2021

So, if 2020 was one of the strangest years on record, is 2021 the “hold my beer” year? Mortgage Bankers Association President & CEO says the real estate finance industry is facing a “very different landscape” fraught with potential difficulties.

MBA Asks FHFA to Align Actions on Climate Change with Core Principles

The Mortgage Bankers Association recommended the Federal Housing Finance Agency align its actions on climate change and natural disaster risks with a set of core principles to reduce risk.

MBA Urges No Delay to CFPB QM Final Rule

The Mortgage Bankers Association, in a letter yesterday to the Consumer Financial Protection Bureau, urged the Bureau not to delay the effective date of its new General Qualified Mortgage Rule, saying the Bureau’s rationale for delaying the rule would not accomplish its stated goals nor benefit consumers.

HUD: FHA Mutual Mortgage Insurance Fund Programs on Track; No Plans to Change Premiums

HUD released its quarterly report to Congress on the FHA Single-Family Mutual Mortgage Insurance Fund Programs. The report said the MMIF stands at more than $80 billion and remains well above the 2% minimum capital reserve required by Congress.

MBA Urges Treasury, FHFA to Reconsider GSE Purchase Caps

The Mortgage Bankers Association on Monday asked for a meeting with Treasury and Federal Housing Finance Agency officials to address MBA member concerns over newly imposed limits on government-sponsored enterprise operations that could cause potential disruptions to the housing finance system.

Sen. Toomey Issues Housing Finance Reform Principles

Sen. Pat Toomey, R-Pa., ranking member of the Senate Banking Committee, yesterday released a set of guiding principles for housing finance reform, a move welcomed by the Mortgage Bankers Association.

MBA Expresses Concerns over GSE Limits on Second Homes, Investor Properties

The Mortgage Bankers Association said it is concerned over new limits on loan deliveries for second homes and investor properties by Fannie Mae and Freddie Mac.