The level of commercial/multifamily mortgage debt outstanding increased by $53.4 billion (1.1%) in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

Tag: Reggie Booker

MBA: Commercial and Multifamily Mortgage Delinquency Rates Mixed in Third-Quarter 2025

Commercial mortgage delinquencies were mixed in the third quarter of 2025, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

MBA: Commercial and Multifamily Mortgage Debt Outstanding Increased in Second-Quarter 2025

The level of commercial/multifamily mortgage debt outstanding increased by $47.1 billion (1%) in the second quarter of 2025, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report. Total commercial/multifamily mortgage debt outstanding rose to $4.88 trillion at the end of the second quarter. Multifamily mortgage debt alone increased $27.7 billion (1.3%) to $2.19 trillion from the first quarter of 2025.

MBA: Commercial, Multifamily Mortgage Delinquency Rates Increased in Second Quarter

Commercial mortgage delinquencies increased in the second quarter of 2025, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report.

MBA: Commercial, Multifamily Mortgage Debt Outstanding Increased in First Quarter

The level of commercial/multifamily mortgage debt outstanding increased by $46.8 billion (1.0%) in the first quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

Chart of the Week: Latest Delinquency Rates and Range Since 1996

Commercial mortgage delinquencies increased across all major capital sources in the first quarter of 2025, according to the Mortgage Bankers Association’s (MBA) latest Commercial Delinquency Report. While overall delinquency rates remain relatively low by historical standards, the increases highlight growing stress in parts of the market, particularly in sectors facing refinancing challenges or weakened fundamentals.

MBA: Commercial and Multifamily Mortgage Delinquency Rates Increase in First-Quarter 2025

Commercial mortgage delinquencies increased in the first quarter, according to the Mortgage Bankers Association’s latest Commercial Mortgage Delinquency Rates Report.

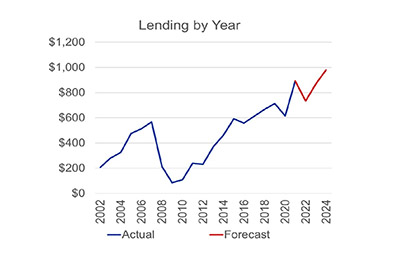

MBA Forecast: Higher Rates, Economic Uncertainty to Slow Commercial/Multifamily Lending

Total commercial and multifamily mortgage borrowing and lending could fall to $733 billion this year, down 18 percent from 2021 totals, according to an updated baseline forecast from the Mortgage Bankers Association.

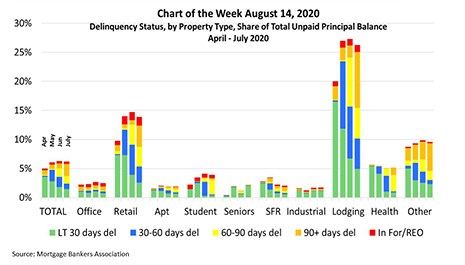

MBA Chart of the Week: Delinquency Rate for Commercial/Multifamily Mortgages

The delinquency rate for commercial and multifamily mortgages declined in July. The rate had increased sharply in April at the onset of the pandemic, with 3.6% of loan balances becoming newly delinquent. In May, delinquencies increased again, with a new, but smaller, cohort of newly delinquent loans.