Nearly 70% of mortgage professionals surveyed by AD Mortgage, Fort Lauderdale, Fla., said 2025 was a better year for business than 2024.

Tag: Refinances

ICE: Mortgage Refinance Retention Reaches Multi-Year High

Mortgage servicer refinance retention rose to a 3.5-year high in the third quarter as falling interest rates encouraged homeowners to reduce monthly payments for lower returns than in past cycles.

Optimal Blue: Refinances Up, Purchase Activity Down, Non-QM Hits Record High

Refinances ticked up and non-QM lending hit a record high as purchase activity fell nearly 5% in July, according to Optimal Blue, Plano, Texas.

Optimal Blue: February Sees Surge in Rate-and-Term Refinances

Optimal Blue, Plano, Texas, recorded a 7% month-over-month increase in mortgage lock volume in February, largely driven by strong refinance activity.

MBA NewsLink Q&A with Ardley Technologies CEO Nathan Den Herder

MBA NewsLink interviewed Nathan Den Herder, founder and CEO of Ardley Technologies, a provider of mortgage technology solutions that help lenders and servicers mine their portfolios for new deal opportunities and improve retention rates.

Total Expert’s Joe Welu: Retention Is the Key to Winning the 2024 Refi Surge

We knew it was coming—eventually. After 11 rate hikes starting in March 2022, the Fed in December 2023 signaled its intentions to lower rates through 2024. With mortgage rates already dropping, virtually everyone that bought a home in the last 18 months will benefit from a refinancing conversation with their lender.

Fewer Than 1 in 5 With Pre-Pandemic Mortgages Have Refinanced

Despite record low interest rates, just 19 percent of homeowners with a mortgage they had prior to the pandemic have refinanced since COVID-19 started, according to Bankrate.com.

Despite Record Low Rates, Most Homeowners Pass on Refinancing

A Zillow survey of more than 1,300 homeowners found despite record low interest rates, more than three-fourths of respondents passed up the opportunity to refinance their mortgage.

FHFA Announces New Refi Option for Low-Income Borrowers with GSE-Backed Mortgages

The Federal Housing Finance Agency on Wednesday announced Fannie Mae and Freddie Mac will implement a new refinance option for low-income borrowers with government-sponsored enterprise-backed single-family mortgages.

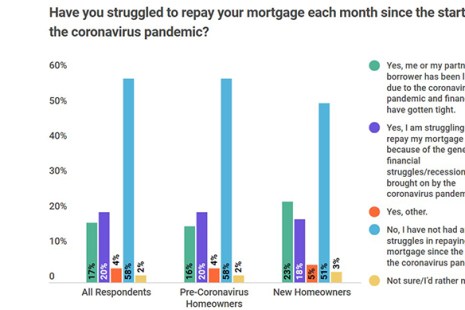

Regrets? For Some Homeowners During Pandemic, a Few

A new survey from LendEDU, Hoboken, N.J., finds more than half of new homeowners regret taking out a mortgage during the coronavirus pandemic, with most of them citing a job layoff as the reason for their angst.