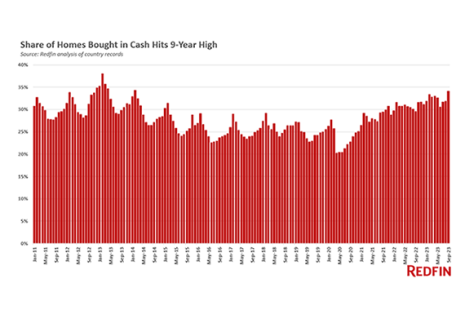

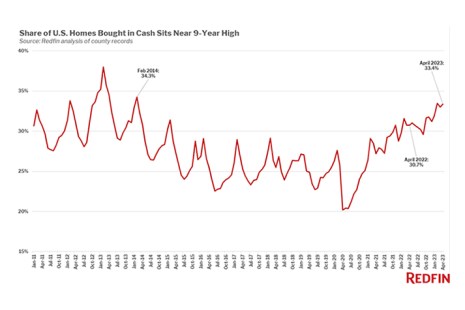

Redfin, Seattle, reported the share of homes bought in all cash hit its highest level since 2014 in September as elevated mortgage rates made paying in cash more attractive.

Tag: Redfin

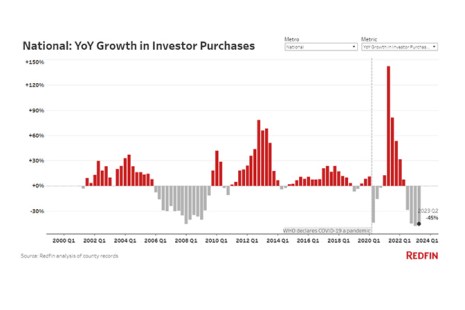

Real Estate Investors Buying 45% Fewer Homes Than Last Year, Redfin Finds

Redfin, Seattle, reported that the drop in home purchases by investors outpaced the second-quarter drop in overall home sales. Investor home purchases fell 45% from last year, compared with an overall market drop of 31%.

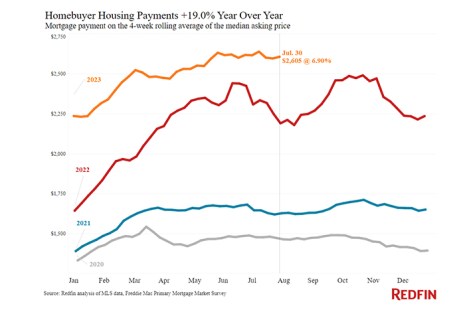

Redfin: Typical Monthly Payment Up Nearly 20% From Last Year

Redfin, Seattle, found the typical U.S. homebuyer’s monthly payment is up 19% from a year ago, at $2,605, during the four weeks ending July 30.

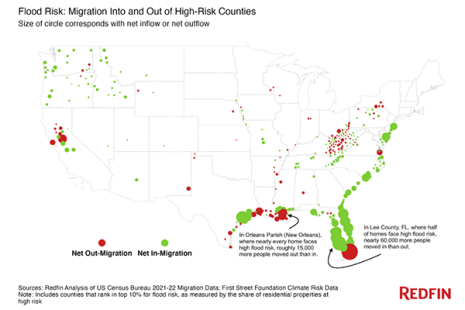

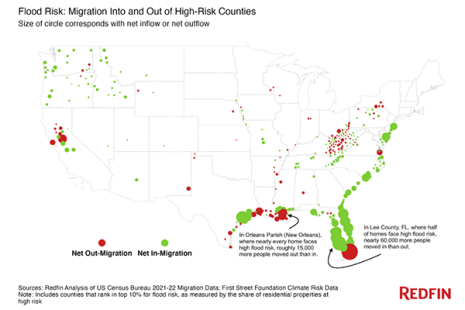

Redfin Reports Migration Into Flood-Prone Areas Has More Than Doubled Since 2020

The most flood-prone U.S. counties saw 384,000 more people move in than out in 2021 and 2022—a 103% increase from the prior two years, reported Redfin, Seattle.

Redfin Reports Migration Into Flood-Prone Areas Has More Than Doubled Since 2020

The most flood-prone U.S. counties saw 384,000 more people move in than out in 2021 and 2022—a 103% increase from the prior two years, reported Redfin, Seattle.

Quote Tuesday, July 25, 2023

“The consequences of climate change haven’t fully sunk in for many Americans because oftentimes, homeowners and renters don’t foot the whole bill when disaster strikes. Insurers and government programs frequently subsidize the cost of rebuilding after storms hit, and mortgages mean homeowners are ceding some risk to lenders—especially if their house goes into foreclosure after a storm.”

–Redfin Chief Economist Daryl Fairweather

One-Third of Homebuyers Used Cash in April, Redfin Finds

Redfin, Seattle, reported 33.4% of home purchases in April were all-cash, almost the highest share in nine years and up from 30.7% in April 2022.

Typical Home Changes Hands Every 12 Years, Down from 2020 Peak

Redfin, Seattle, reported the typical U.S. homeowner has spent 12.3 years in their home, down from the peak of 13.4 years hit in 2020 and 12.9 years in 2021.

Homebuyers See Relief from Prices, Monthly Payments

Redfin, Seattle, said homebuyers in many markets are starting to see relief from home prices and monthly payments.

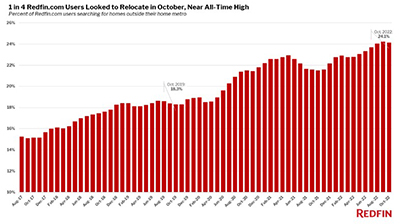

Redfin: Home Relocation Near Record High

The share of Redfin.com users looking to move to a different metro area is near its record high as high rates and prices up the appeal of affordable places.