MBA’s President and CEO Bob Broeksmit, CMB, released the following statement regarding the Financial Stability Oversight Council’s (FSOC) report released Friday on nonbank mortgage servicing:

Tag: Nonbank Mortgage Servicers

The FHFA 2022-2026 Strategic Plan: What It Means for MBA Members

The Federal Housing Finance Agency last week released its 2022-2026 Strategic Plan for Fiscals Years 2022-2026, focusing guiding Fannie Mae, Freddie Mac and the Federal Home Loan Bank System for the next five years.

Fitch: Non-Bank Mortgage Servicers Face Increasing Regulatory Scrutiny

Fitch Ratings, New York, said regulatory scrutiny of servicing practices at U.S. mortgage companies is expected to increase in 2022 as pandemic-related government forbearance programs expire and borrowers transition into other permanent loss mitigation alternatives or default.

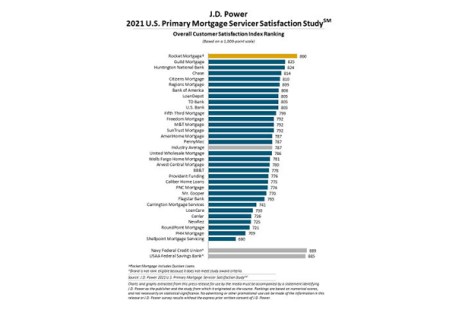

J.D. Power: Mortgage Servicers Get High Marks; Nonbanks Gain Traction

J.D. Power, Troy, Mich., said mortgage servicers earned high levels of customer satisfaction during the pandemic, but warned as loan forbearance programs come to an end and more normalized customer interactions resume, traditional banks are starting to lose their edge over non-bank lenders.

MBA Supports CSBS Prudential Standards for Nonbank Mortgage Servicers

Last Tuesday the Conference of State Bank Supervisors released model state regulatory prudential standards for nonbank mortgage servicers. MBA President and CEO Bob Broeksmit, CMB, immediately expressed support for the standards.