Late last summer, Fannie Mae’s pre-funding quality control review requirements for agency loans caught the attention of an unexpected mortgage industry segment: Non-QM/Non-Agency loan originators. MBA NewsLink asked Pamela Hamrick, President of Incenter Diligence Solutions, to explain.

Tag: Non-QM Mortgages

Dave Parker: Rebounding Non-QM Market Requires Quality Review to Mitigate Risk

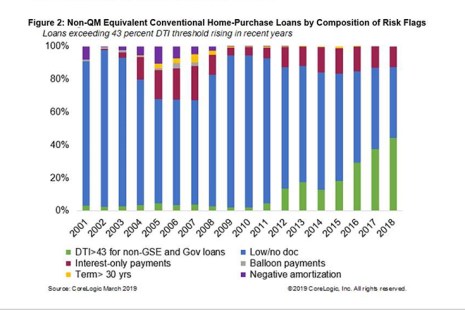

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers and investors?

Portfolio Risk Management: Repurchase Risk for Non-QM Mortgages

In the wake of the 2008 global financial crisis, many risk managers in the mortgage issuance industry were caught flat-footed with representations and warranties exposure, also commonly known as repurchase exposure. R&W agreements often require the issuer of mortgages to repurchase the loans and make whole the investors if the loans are found to breach the seller guidelines.