RealPage, Richardson, Texas, found more than 75% of survey participants report an increase in rental fraud in their multifamily communities in the past year.

Tag: Multifamily

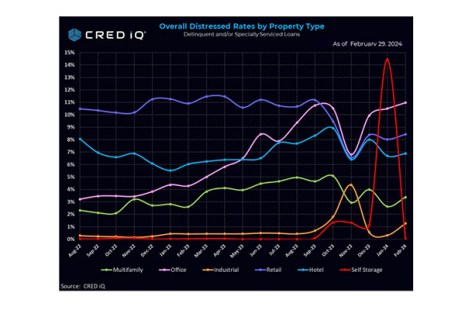

CRED iQ: Multifamily Distress Rate Up 80 Basis Points in February

CRED iQ, Wayne, Pa., reported the Distress Rate for all property types trimmed 4 basis points in February to 7.35%. However, the multifamily distress rate was up 80 basis points–the largest monthly increase in that sector in more than a year and a half.

Fannie Mae, Freddie Mac Multifamily Officials: Workforce Housing, Property Conditions Key Issues–#MBACREF24

SAN DIEGO–The environment remains challenging but issues such as workforce housing, renter protections and property conditions and insurance are prime topics for Freddie Mac and Fannie Mae, officials from each said during a Feb. 13 session at the MBA Commercial/Multifamily Finance Convention and Expo.

MBA Submits Comments on FHFA Proposed GSE 2022-2024 Housing Goals

The Mortgage Bankers Association on Monday submitted comments to the Federal Housing Finance Agency on its proposed rule for 2022-2024 housing goals for Fannie Mae and Freddie Mac.

FHFA Extends COVID-19 Multifamily Forbearance

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners as needed, subject to tenant protections the agency imposed during the pandemic.

MBA Urges FHFA to Extend Current GSE Affordable Housing Goals

The Mortgage Bankers Association, in a letter this morning to the Federal Housing Finance Agency, said FHFA should extend current affordable housing goals for Fannie Mae and Freddie Mac, given current economic uncertainty.

Longer-Term Challenges to Multifamily Risk Outlook Emerge

The multifamily sector made it through the first half of the year with less turmoil as some anticipated. But the pandemic could create longer-term challenges for the sector, said Phoenix American, San Rafael, Calif.

FHFA: Multifamily Owners in Forbearance Must Inform Tenants of Eviction Suspension, Tenant Protections

The Federal Housing Finance Agency announced Thursday multifamily property owners with mortgages backed by Fannie Mae or Freddie Mac who enter into a forbearance agreement must inform their tenants about protections during the property owner’s forbearance and repayment periods.

FHFA Leaves 2021 GSE Housing Goals Unchanged

With current housing goals set to expire in December, and amid economic uncertainty stemming from the lingering coronavirus pandemic, the Federal Housing Finance Agency yesterday left 2021 housing goals for Fannie Mae and Freddie Mac unchanged from the previous three years.

GSEs Extend Multifamily Forbearance

The Federal Housing Finance Agency announced Fannie Mae and Freddie Mac will allow servicers to extend forbearance agreements for multifamily property owners with existing forbearance agreements.