The Federal Housing Finance Agency yesterday issued two directives to Fannie Mae and Freddie Mac—one to enter into additional dollar roll transactions to provide mortgage-backed securities investors with short-term financing of their positions; and the other to provide alternative flexibilities to satisfy appraisal requirements and employment verification requirements.

Tag: Mortgage-Backed Securities

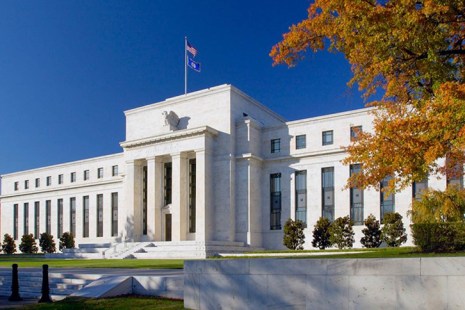

Fed Bolsters Efforts to Stem Economic Impact of Coronavirus

The Federal Reserve, in its most aggressive actions to date, announced further steps yesterday to mitigate the economic impact of the coronavirus pandemic, including actions strongly advocated for over the weekend by the Mortgage Bankers Association.

MBA, Trade Groups Urge FHFA to Use Caution on Changes to GSE UMBS Pooling Practices

The Mortgage Bankers Association, in a letter to Federal Housing Finance Agency Director Mark Calabria, urged caution on a proposed “waterfall approach” to pooling practices used by Fannie Mae and Freddie Mac in the Uniform Mortgage-Backed Security market, saying in its current form the proposal could have a “negative effect” on market liquidity, raise borrowing costs and reduce access to credit.