Loans in forbearance continued their downward trend, the Mortgage Bankers Association reported Monday, and the number of homeowners in forbearance plans fell below 1.5 million.

Tag: Mike Fratantoni

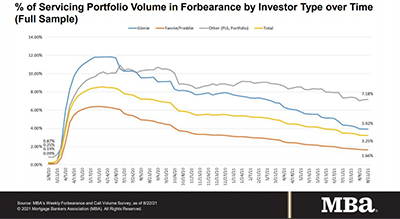

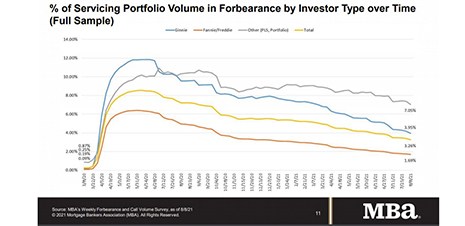

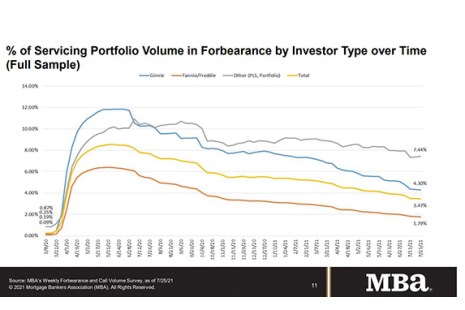

MBA: Loans in Forbearance Fall Under 3%

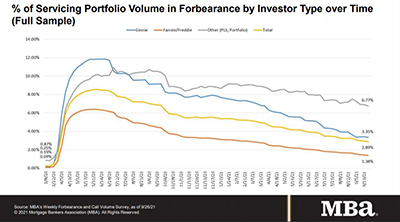

Loans in forbearance fell to under 3 percent for the first time since March 2020, the Mortgage Bankers Association reported Monday.

Share of Mortgage Loans in Forbearance Falls to 3.00%

Mortgage loans in forbearance fell to yet another post-pandemic low and threatened to fall under 3 percent for the first time in more than a year and a half, the Mortgage Bankers Association reported on Monday.

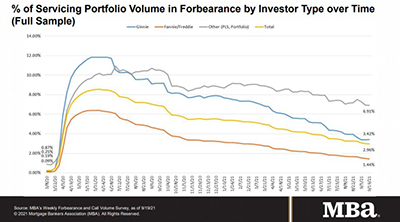

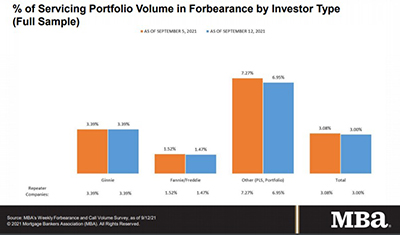

Share of Mortgage Loans in Forbearance Drops to 3.08%

Forbearance exits saw their fastest pace since March, the Mortgage Bankers Association reported Monday afternoon in its weekly Forbearance and Call Volume Survey.

Share of Mortgage Loans in Forbearance Unchanged at 3.25%

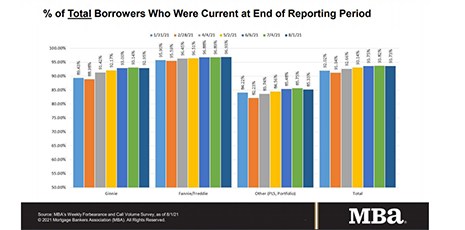

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance remained unchanged at 3.25% as of August 22. MBA estimates 1.6 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Dips to 3.25%

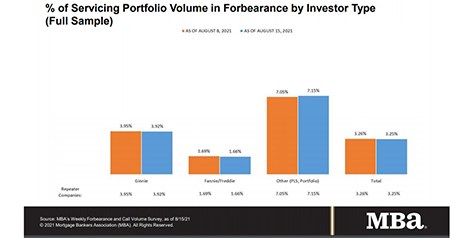

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 1 basis point to 3.25% of servicers’ portfolio volume as of August 15 from 3.26% the week prior. MBA estimates 1.6 million homeowners are in forbearance plans.

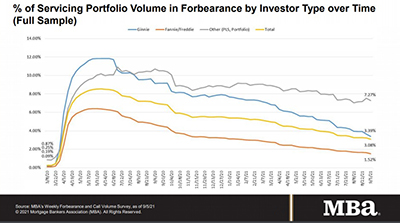

Share of Mortgage Loans in Forbearance Decreases to 3.26%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 14 basis points to 3.26% of servicers’ portfolio volume as of August 8 from 3.40% the previous week. MBA now estimates 1.6 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Decreases to 3.40%

New forbearance requests fell to a three-week low, the Mortgage Bankers Association reported Monday.

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

Share of Mortgage Loans in Forbearance Slightly Dips to 3.48%

Loans in forbearance fell for the 21st consecutive week, the Mortgage Bankers Association said on Monday.