LAS VEGAS—Real estate finance has migrated quickly from a person-to-person business to a person-to-tech-device-to-person business. And socio-economic forces are rapidly steering technology to reshape business—even as business continues to fine-tune technology.

Tag: Mike Fratantoni

A More Challenging Economic Environment for IMBs

NASHVILLE, Tenn.—The nation’s economy—and just as importantly, the housing market—are as challenging and as opportunistic in any time in history, according to Mortgage Bankers Association economists.

Final MBA Forbearance & Call Volume Survey: Mortgage Loans in Forbearance Drops to 2.06%

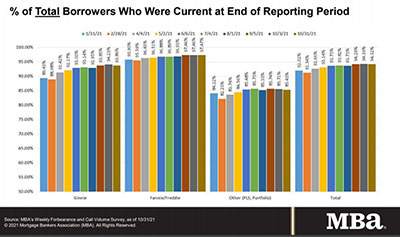

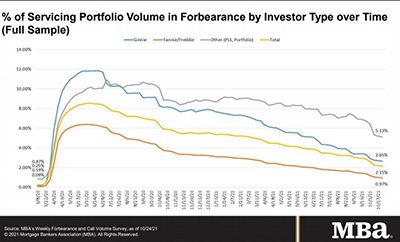

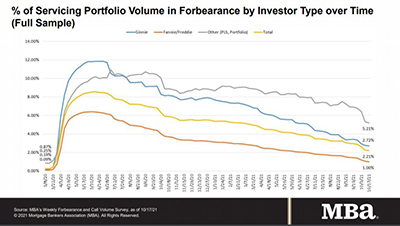

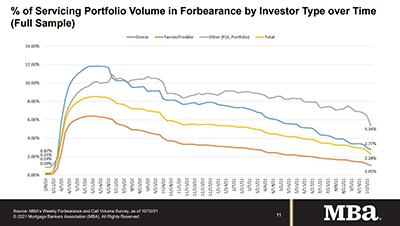

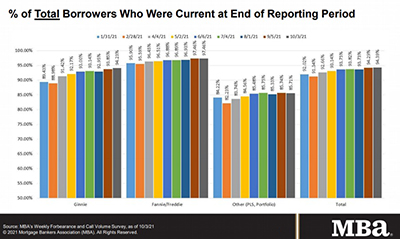

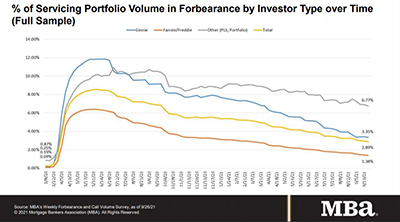

The Mortgage Bankers Association issued its final Forbearance and Call Volume Survey on Monday; 77 weeks after its first survey, MBA reported one million homeowners in forbearance plans, down from more than six million in mid-2020.

Share of Mortgage Loans in Forbearance Drops to 2.15%

Loans in forbearance fell to a new post-pandemic low, with the share of Fannie Mae/Freddie Mac loans in forbearance falling under 1%, the Mortgage Bankers Association reported Monday.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

Share of Mortgage Loans in Forbearance Decreases to 2.21%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 7 basis points to 2.21% of servicers’ portfolio volume as of October 17 from 2.28% the week before. MBA estimates 1.1 million homeowners are in forbearance plans.

Share of Mortgage Loans in Forbearance Decreases to 2.28%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans in forbearance decreased by 34 basis points to 2.28% as of October 10.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

Share of Mortgage Loans in Forbearance Decreases to 2.62%

Mortgage borrowers exited forbearance at the fastest rate in more than a year, the Mortgage Bankers Association reported Monday.

Share of Mortgage Loans in Forbearance Decreases to 2.89%

Loans in forbearance continued their downward trend, the Mortgage Bankers Association reported Monday, and the number of homeowners in forbearance plans fell below 1.5 million.