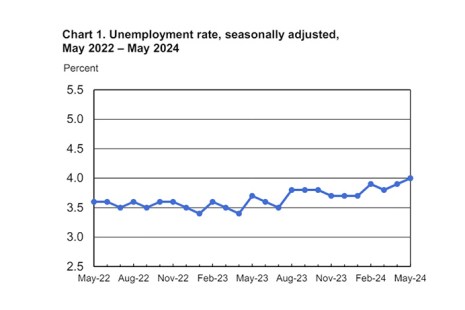

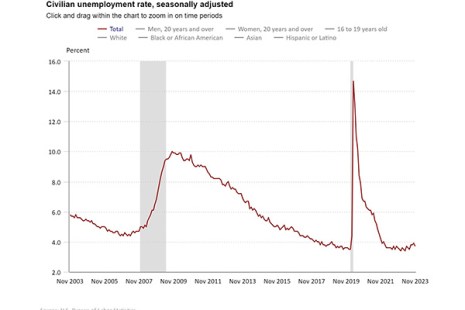

The U.S. Bureau of Labor Statistics announced nonfarm payroll increased by 272,000 and the unemployment rate was at 4% in May.

Tag: Mike Fratantoni

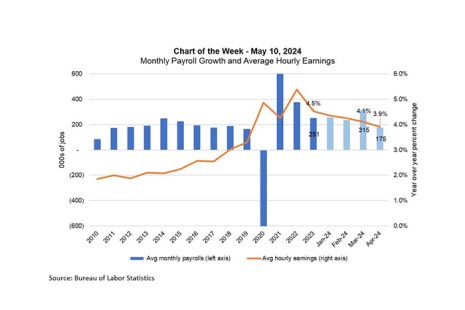

MBA Chart of the Week: Monthly Payroll Growth, Average Hourly Earnings

The Federal Open Market Committee (FOMC) left the federal funds target unchanged at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the expected timing of a first rate cut.

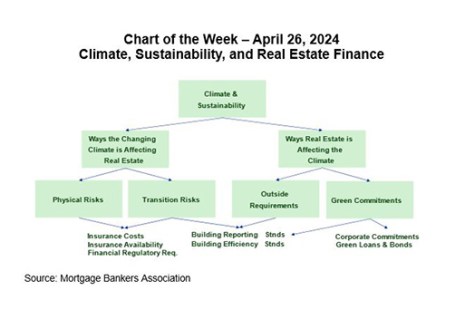

MBA Chart of the Week: Climate, Sustainability and Real Estate Finance

With Earth Day happening this month, it seems an opportune time to discuss the intersection of climate/sustainability issues and real estate finance. MBA has been leading on these issues for more than half a decade, helping members through our work related to research, policy and practice.

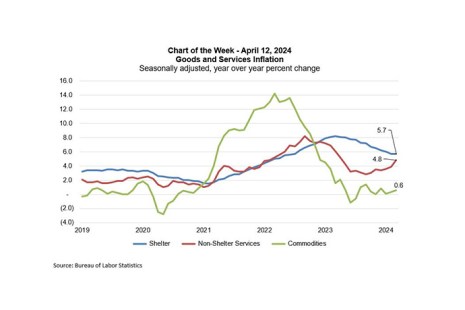

MBA Chart of the Week: Goods and Services Inflation

The week’s news has been around the Consumer Price Index (CPI) release showing that inflation was hotter than expected in March, which is likely to delay the Federal Reserve’s first rate cut in 2024 and contributed to a significant spike in the 10-year Treasury yield to over 4.5%.

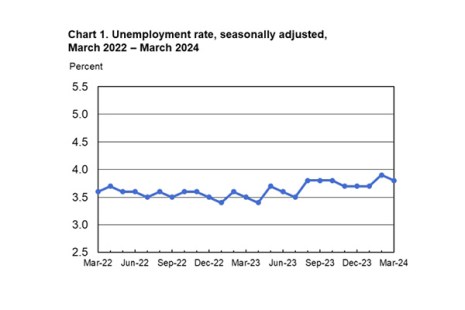

U.S. Adds 303,000 Jobs in March

Total nonfarm payroll employment grew by 303,000 in March, per the U.S. Bureau of Labor Statistics.

MBA’s Michael Fratantoni Provides Market Outlook, Notes ‘It’s Not 2008’

WASHINGTON–The industry has plentiful challenges, but is in a very different spot than during the Great Recession, said Michael Fratantoni, Mortgage Bankers Association Chief Economist and Senior Vice President of Research and Industry Technology, here at the National Advocacy Conference.

Statement of MBA’s Michael Fratantoni Before the House Financial Services Subcommittee on Housing and Insurance

Mike Fratantoni, MBA’s Chief Economist and SVP of Research and Industry Technology, testified last week at a hearing titled, “The Characteristics and Challenges of Today’s Homebuyers” before the Committee on Financial Services Subcommittee on Housing and Insurance.

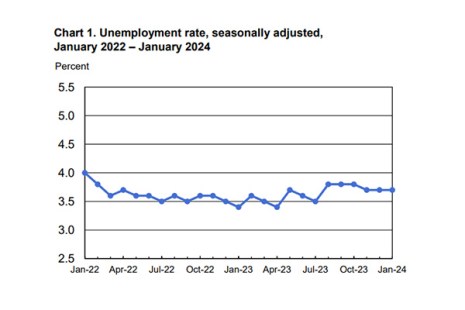

U.S. Economy Adds 353,000 Jobs in January

Total nonfarm payroll employment rose by 353,000 in January, with the unemployment rate flat at 3.7%, the Bureau of Labor Statistics reported Feb. 2.

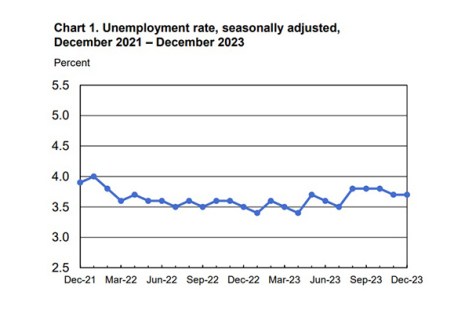

Job Market Grows by 216,000 in December

The job market held steady in December, with growth in payrolls of 216,000 and the unemployment rate unchanged at 3.7%, the U.S. Bureau of Labor Statistics reported Friday.

Jobs Increase in November, Unemployment Rate at 3.7%

Total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate now sits at 3.7%, the U.S. Bureau of Labor Statistics reported.