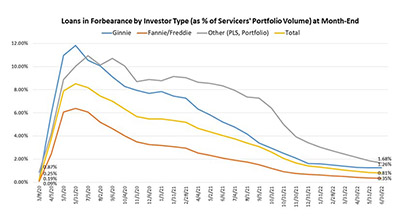

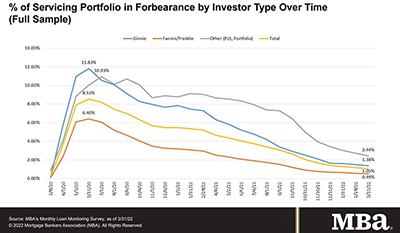

According to MBA’s Monthly Loan Monitoring Survey, the share of loans in forbearance dropped slightly to 0.81 percent of servicers’ portfolio volume as of June 30, from 0.85 percent the prior month. Only about 404,000 homeowners are still in forbearance plans, after reaching a peak of nearly 4.3 million homeowners in May 2020.

Tag: MBA Loan Monitoring Survey

MBA: Share of Mortgage Loans in Forbearance Decreases Slightly in June

he Mortgage Bankers Association’s monthly Loan Monitoring Survey revealed the total number of loans now in forbearance decreased by 4 basis points from 0.85% of servicers’ portfolio volume in May to 0.81% on June 30.

Share of Mortgage Loans in Forbearance Falls to 0.85%

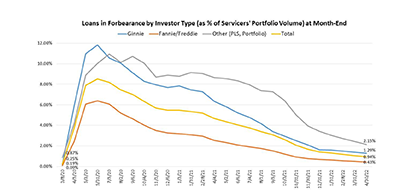

Mortgage loans in forbearance fell to new post-pandemic lows in May, the Mortgage Bankers Association reported.

Share of Mortgage Loans in Forbearance Falls Under 1%

Loans in forbearance fell below 1%, the Mortgage Bankers Association reported Monday.

MBA: Share of Mortgage Loans in Forbearance Decreases to 1.05%

Loans in forbearance fell to another pre-pandemic low to just barely above 1%, the Mortgage Bankers Association reported Monday.

MBA: Share of Mortgage Loans in Forbearance Drops to 1.18%

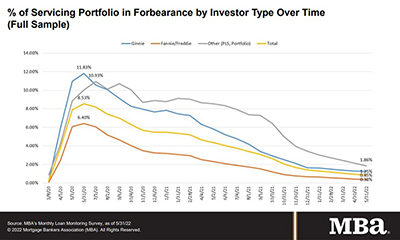

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans now in forbearance decreased by 12 basis points to 1.18% of servicers’ portfolio volume as of Feb. 28 from 1.30% in January. MBA estimates 590,000 homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Drops to 1.30%

Loans in forbearance fell again in January to pre-pandemic lows, the Mortgage Bankers Association reported on Monday.

MBA: Share of Mortgage Loans in Forbearance Decreases to 1.41% in December

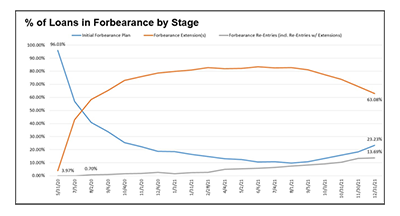

Loans now in forbearance decreased 26 basis points during December to 1.41% of servicers’ portfolio volume as of December 31, the Mortgage Bankers Association’s new monthly Loan Monitoring Survey reported.

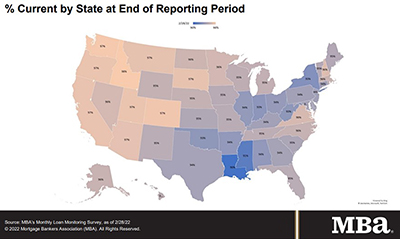

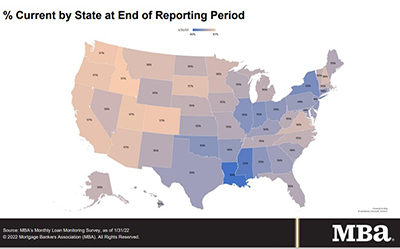

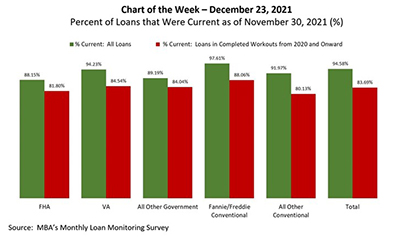

MBA Chart of the Week Dec. 23 2021: Percent of Current Loans

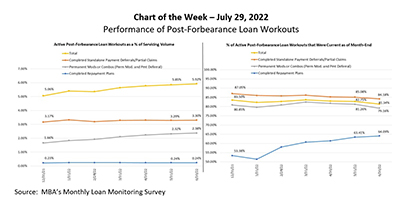

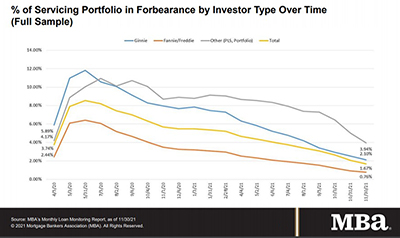

According to the MBA Monthly Loan Monitoring Survey, the share of loans in forbearance dropped to 1.67 percent of servicers’ portfolio volume as of November 30, after climbing to a monthly peak of 8.53 percent as of May 31, 2020. As many borrowers have moved out of forbearance and into permanent loan workout solutions since 2020, the question becomes: How are they faring?

MBA Loan Monitoring Survey: Mortgage Loans in Forbearance Fall to 1.67%

The Mortgage Bankers Association’s new monthly Loan Monitoring Survey reported loans now in forbearance decreased by 39 basis points to 1.67% of servicers’ portfolio volume as of November 30 from 2.06% in October. MBA estimates 835,000 homeowners remain in forbearance plans.