The Mortgage Bankers Association released its revised monthly Economic Forecast and monthly Mortgage Finance Forecast. Here are highlights and commentary from MBA Associate Vice President of Economic and Industry Forecasting Joel Kan.

Tag: MBA Economic Forecast

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

MBA Forecast: 2022 Purchase Originations to Increase 9% to Record $1.7 Trillion

SAN DIEGO–The Mortgage Bankers Association said purchase mortgage originations are expected to grow 9% to a record $1.725 trillion in 2022.

Slight Revisions to MBA Mortgage Finance, Economic Forecasts

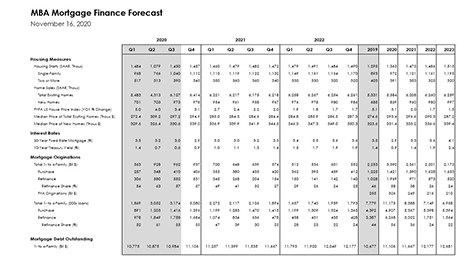

Following one of the most volatile years in memory, the Mortgage Bankers Association’s latest Mortgage Finance and Economic Forecasts seem decidedly normal.

MBA: Upward Revisions to 2020, 2021 Mortgage Forecasts

The most volatile and unpredictable economy in a decade has produced the strongest housing market in more than a decade—and, according to the Mortgage Bankers Association, it could get even stronger.

MBA: Upward Revisions to 2020, 2021 Mortgage Forecasts

The most volatile and unpredictable economy in a decade has produced the strongest housing market in more than a decade—and, according to the Mortgage Bankers Association, it could get even stronger.

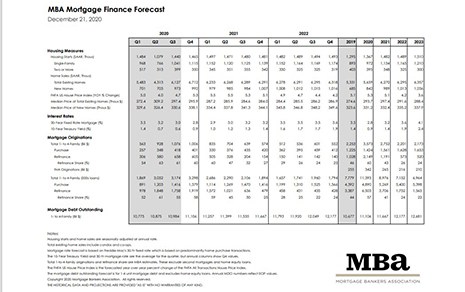

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

Fannie Mae: Lenders’ Profit Margin Outlook Hits High on Strong Consumer Demand

Fannie Mae, Washington, D.C., said mortgage lenders’ profit margin outlook for the next three months reached a new survey high based on data collected last month.