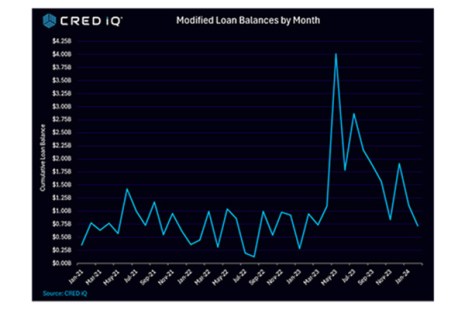

CRED iQ, Wayne, Pa., reported the number of commercial loan modifications jumped significantly in 2023 from 2022. And, the firm anticipates that trend will persist in 2024.

Tag: Loan Modifications

Government Roundup: FHA Publishes 40-Year Loan Mod Final Rule; CFPB Targets ‘Junk Fees’

In this week’s Government Roundup, FHA published a final rule that would permit 40-year terms for loan modifications; and the Consumer Financial Protection Bureau released a special edition of its Supervisory Highlights targeting allegedly unlawful junk fees uncovered in deposit accounts and in multiple loan servicing markets, including in mortgage, student and payday lending.

MISMO Launches Initiative to Apply Digital Mortgage Standards to Loan Modification Process

MISMO, the Mortgage Industry Standards Maintenance Organization, seeks industry participants to join its initiative of applying digital mortgage standards, guidelines and best practices to the loan modification process.

House Democrats Add Pressure on Administration for Mortgage Servicing Liquidity

Twenty-seven House Democrats sent a letter last week to Administration officials urging them to take further steps to allow mortgage borrowers to avoid delinquency and to support mortgage servicers who are working with these borrowers.

FHFA, CFPB Announce Borrower Protection Program

The Federal Housing Finance Agency and the Consumer Financial Protection Bureau announced the Borrower Protection Program, a joint initiative that enables CFPB and FHFA to share servicing information to protect borrowers during the coronavirus national emergency.

Federal Agencies ‘Will not Criticize’ Coronavirus Loan Mods

Six federal agencies on Sunday issued a joint statement encouraging financial institutions to “work constructively” with borrowers affected by the coronavirus pandemic and said they “will not criticize” loan modifications made in a “safe and sound” manner.

FHFA: Nearly 4.4 Million Homeowners Helped Since Conservatorship

The Federal Housing Finance Agency released its quarterly Foreclosure Prevention and Refinance Report, showing Fannie Mae and Freddie Mac completed 26,475 foreclosure prevention actions in the third quarter, bringing the total number of foreclosure prevention actions to 4.38 million since September 2008.