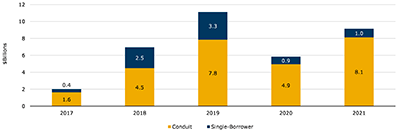

Kroll Bond Rating Agency, New York, reported commercial mortgage-backed securities defeasance volume rebounded strongly last year after falling by nearly half in 2020.

Tag: Larry Kay

KBRA Analysts Look to 2022 Commercial Mortgage-Backed Securities Sector

MBA NewsLink interviewed KBRA’s Larry Kay and Patrick McQuinn to get their insights on the current lending environment and property fundamentals as well as factors that may affect property performance in 2022.

CMBS Delinquency, Special Servicing Rates Improve

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in June–but not by much.

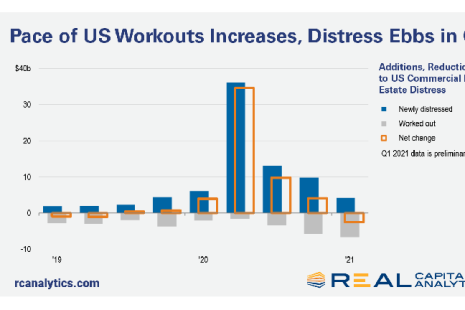

1Q Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

Moody’s Sees ‘Drastic Drop’ in CMBS Supply-Demand Fundamentals

Moody’s Investors Service, New York, said the supply and demand outlook for most property types in the securitized commercial real estate market fell “drastically” in the first quarter.