Kroll Bond Rating Agency, New York, said commercial mortgage-backed security servicers “performed admirably” over the last two years while facing nearly unprecedented distress during the COVID pandemic.

Tag: Kroll Bond Rating Agency

CMBS Delinquency Rate, Liquidations Drop

The commercial mortgage-backed securities delinquency rate continues to decline, and CMBS liquidations also dropped last year, analysts said.

CMBS Delinquency, Special Servicing Rates Dip in December

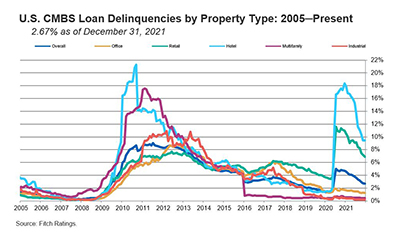

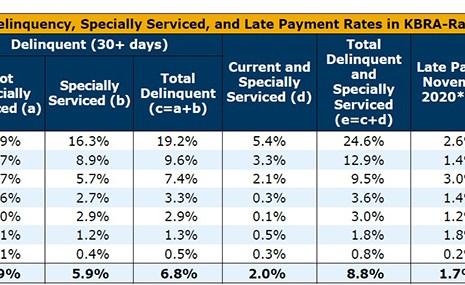

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate dipped nine basis points in December to 2.67 percent, driven by robust new issuance, continued loan resolutions and fewer new delinquencies.

KBRA Analysts Look to 2022 Commercial Mortgage-Backed Securities Sector

MBA NewsLink interviewed KBRA’s Larry Kay and Patrick McQuinn to get their insights on the current lending environment and property fundamentals as well as factors that may affect property performance in 2022.

September CMBS Delinquency, Special Servicing Rates Drop

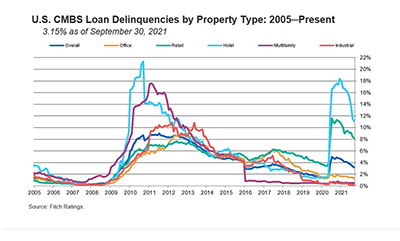

Fitch Ratings, New York, and Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate continued it steady fall in September.

CMBS Delinquency, Special Servicing Rates Dip Again

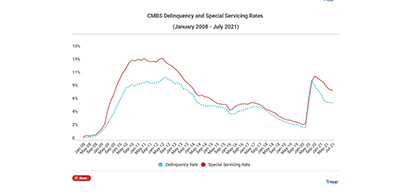

“More of the same” was the commercial mortgage-backed securities delinquency rate headline in July, according to Trepp Senior Managing Director Manus Clancy.

CMBS Delinquency, Special Servicing Rates Improve

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in June–but not by much.

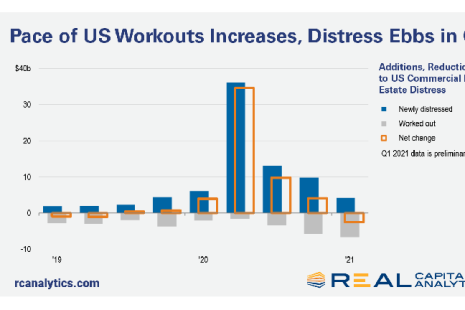

1Q Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, reported Real Capital Analytics, New York.

CMBS Delinquency Rate Dips

The commercial mortgage-backed securities delinquency rate dipped in November, largely due to continued Coronavirus debt relief, said Fitch Ratings, New York.