TransUnion, Chicago, said consumers are increasingly turning to credit to manage their household budgets in the current economic environment, leading to record- or near-record high balances in credit cards and unsecured loans.

Tag: Joe Mellman

Inflation Spurs Consumers to Credit Cards, Home Equity

TransUnion, Chicago, said amid rising interest rates and high inflation, the fourth quarter saw consumers continuing to look to credit as a means to help stave off financial pressures.

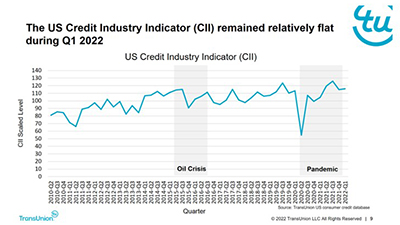

Despite Challenges, 1Q Consumer Credit Health Stays Strong

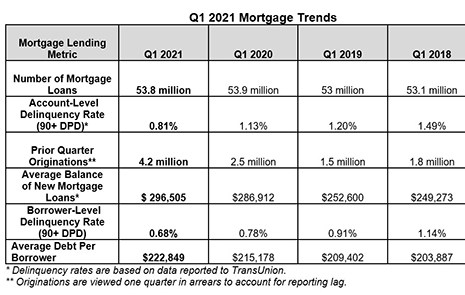

Rising interest rates and increased prices of goods and services placed pressure on the consumer wallet in the first quarter. Despite the challenges, consumers remain well positioned from a consumer credit perspective, according to the Quarterly Credit Industry Insights Report from TransUnion, Chicago.

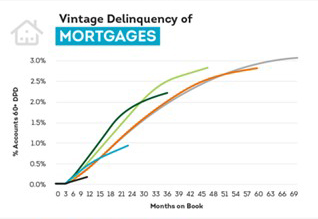

TransUnion: Recent Vintage Loans Perform Well Even as More Non-Prime Consumers Gain Credit

TransUnion, Chicago, said consumer credit performance maintained healthy levels across auto, credit card, personal loans and mortgages in the fourth quarter even as lenders continued to ramp up new account origination growth in the non-prime segment of the market.

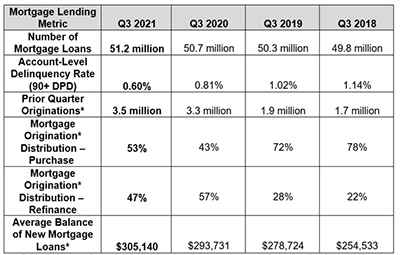

Gen Z Drives Strong Q3 Credit Activity

The credit card industry is rebounding strongly from the early impacts of the COVID-19 pandemic, said TransUnion, Chicago, with Gen Z leading the way in terms of originations and bankcard balance growth and other credit categories, including mortgage.

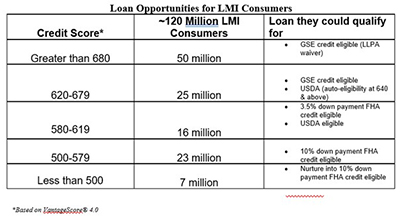

TransUnion: LMI Consumers Present $300 Billion Growth Opportunity for Mortgage Industry

Low-to-moderate income consumers have traditionally been overlooked in the mortgage market and trail non-LMI consumers in terms of homeownership. A new study from TransUnion, Chicago, suggests closing this gap could yield mortgage lenders as much as ~$300 billion in refinance and purchase originations.

TransUnion: Consumer Credit Performance Improving, Demand Increasing

TransUnion, Chicago, said despite shockwaves felt from the COVID-19 pandemic, the consumer credit market is strongly positioned as many parts of the country prepare to enter new phases of re-opening this summer.

TransUnion: Consumer Credit Market Withstands Coronavirus Challenges

TransUnion, Chicago, reported the total percentage of accounts in “financial hardship” status dropped during July for mortgages, auto loans, credit cards and personal loans – marking the first such decrease since the start of the COVID-19 pandemic.

Consumers Poised for Continued Strong Credit Activity

TransUnion, Chicago, said its quarterly Industry Insights Report points to several factors that portend good things for retailers this holiday season.