The Federal Reserve’s Federal Open Markets Committee cut the federal funds rate target by 25 basis points Oct. 29.

Tag: Interest Rates

Fed Cuts Interest Rates 50 Basis Points; MBA Economist Weighs In

The Federal Reserve cut interest rates by 50 basis points Sept. 18.

ICE Mortgage Monitor: Share of Mortgages Above 5% Interest Rate Creeps Up

Intercontinental Exchange, Atlanta, released its latest mortgage monitor with May’s data. Among other findings, 24% of mortgage holders had interest rates of 5% or higher, up from just 10% in 2022.

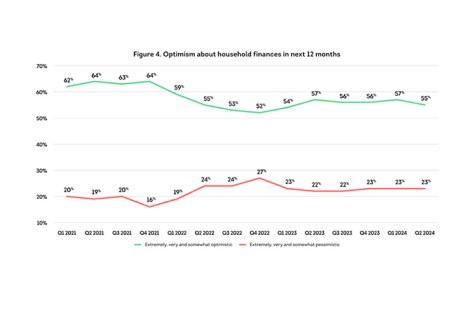

TransUnion: Consumer Outlook Mixed in Q2

TransUnion, Chicago, released its Consumer Pulse Study for the second quarter, finding consumer concerns about inflation and interest rates have hit their highest levels in two years.

Discover Home Loans: Homeowners Leaning Toward Renovation Amid Current Rates

Discover Home Loans, Riverwood, Ill., in a recent survey found 84% of American homeowners who were planning to buy a new home said their decisions have been affected by high interest rates.

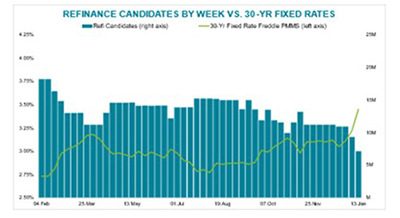

Black Knight: Rising Rates Push Refi Candidates Down to 7.1M

Black Knight, Jacksonville, Fla., said rapidly rising mortgage interest rates have shrunk the number of “high-quality” refinance candidate households to just 7.1 million, the lowest total since November 2019.

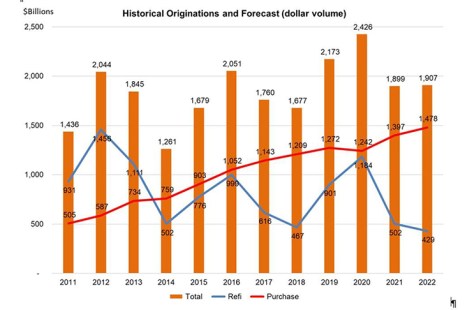

(#MBA Live) Housing, Mortgage Markets Show Resiliency, Agility

With all that has hit the mortgage industry over the past several months, Mortgage Bankers Association Chief Economist Mike Fratantoni has a positive message for mortgage lenders and servicers: “It seems like the industry has done a fantastic job of finding solutions in this crazy environment,” Fratantoni said during MBA Live: Technology Solutions Conference.

MBA April Economic Commentary: Economy Slows Sharply; Massive Job Loss; but V-Shaped Recovery in Forecast

The spread of the coronavirus has slowed global and U.S. economic activity to a halt. Public and private measures to stem the spread of the virus have led to indefinite interruptions in many sectors of the economy, as well as future uncertainty surrounding how long this pause in the global economy will last and what the potential economic losses could be.

Fed Cuts Interest Rates to Zero; Announces $700 Billion in Stimulus

The Federal Reserve on Sunday pre-empted its own regularly scheduled policy meeting this week, announcing an extraordinary full percentage point cut to the federal funds rate and sweeping purchases of government bonds and agency mortgage-backed securities.