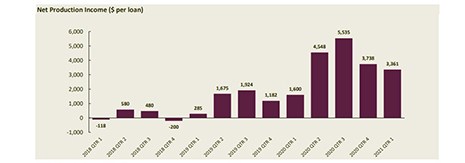

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $2,594 on each loan they originated in the third quarter, up from $2,023 per loan in the second quarter, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

Tag: Independent Mortgage Banks

Despite Quarterly Decline, IMB Production Profits Post Record 1st Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $3,361 on each loan they originated in the first quarter, down from $3,738 per loan in the fourth quarter but still the highest first-quarter net gain in the history of the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

To the Point with Bob–IMBs and the CRA: A Misguided Match

In this edition of To the Point with Bob, MBA President & CEO Robert Broeksmit, CMB, says while the Community Reinvestment Act serves an important policy objective, it is inappropriate to apply it to independent mortgage banks.

MBA: IMB Production Profits Remain Strong in Fourth Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $3,738 on each loan they originated in the fourth quarter down from a reported gain of $5,535 per loan in the third quarter, according to the Mortgage Bankers Association’s latest Quarterly Mortgage Bankers Performance Report.

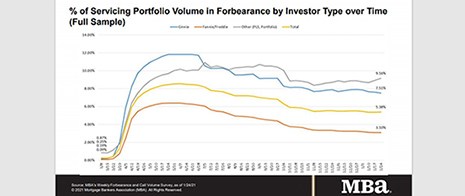

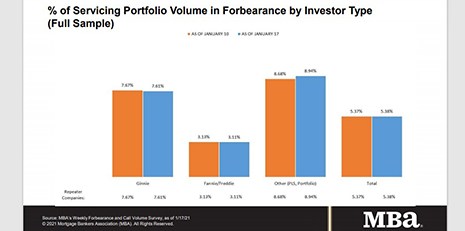

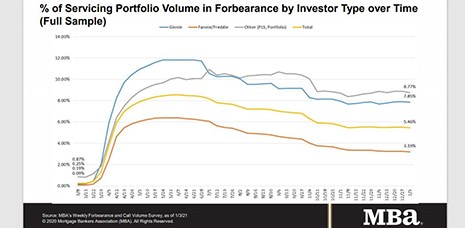

MBA: Share of Loans in Forbearance Unchanged at 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged at 5.38% of servicers’ portfolio volume as of January 24. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Unchanged at 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance remained unchanged at 5.38% of servicers’ portfolio volume as of January 24. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Increases Slightly to 5.38%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased slightly to 5.38% of servicers’ portfolio volume as of Jan. 17 from 5.38% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Loans in Forbearance Drops to 5.46%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.46% of servicers’ portfolio volume as of Jan. 3 compared to 5.46% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

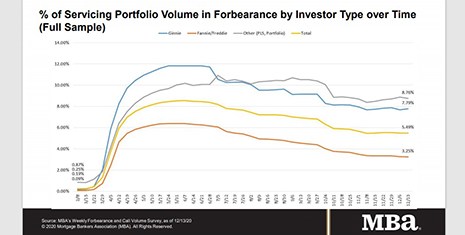

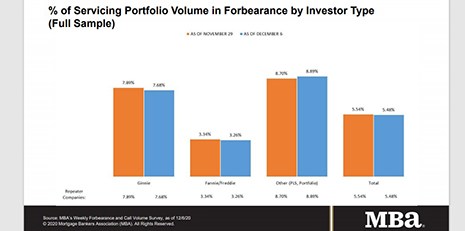

MBA: Share of Mortgages in Forbearance Ticks Up

The Mortgage Bankers Association’s latest Forbearance & Call Center Survey reported loans in forbearance increased slightly to 5.49% of servicers’ portfolio volume as of December 13 from 5.49% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Drops Back to 5.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased to 5.48% of servicers’ portfolio volume as of December 6 from 5.54% the prior week. MBA estimates 2.7 million homeowners are in forbearance plans.