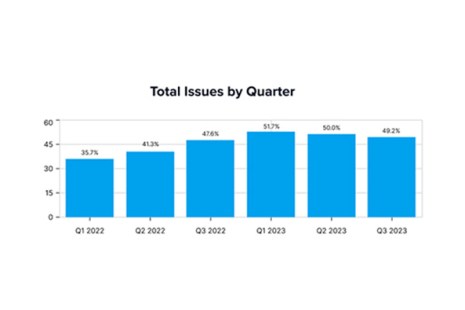

During the fourth quarter, 45.5% of transactions on a $84.1 billion portfolio comprising residential, commercial and business purpose loans had issues leading to a risk of wire & title fraud, according to FundingShield, Newport Beach, Calif.

Tag: Ike Suri

FundingShield: Fraud Risk Still High in Q2

FundingShield, Newport Beach, Calif., released its second-quarter report, finding that 47.08% of transactions in a $74 billion portfolio including residential, commercial and business purpose loans presented some risk.

FundingShield: Concerns of Wire, Title Fraud Still High in Q3

FundingShield, Newport Beach, Calif., reported risks of wire and title fraud remained high in third-quarter data, although fairly flat from the previous quarter.

#MBATech2022: Mortgage Industry Faces Growing Security Risks

LAS VEGAS—Security risks don’t just mean breaches and ransomware. Increasingly, individuals and companies are losing money due to wire fraud and other attacks.

FundingShield Receives MISMO Software Certification for Wire Fraud Prevention Technology

MISMO®, the mortgage industry standards organization, recognized FundingShield, an industry leading innovator within the mortgage fintech industry, with its Premiere Level Certification for their wire fraud prevention software. The Premiere Level Certification is the highest-level certification available by MISMO.