MISMO, the real estate finance industry’s standards organization, announced that it is seeking public comment on a MISMO dataset mapping for the Department of Housing and Urban Development (HUD) Addendum to the Uniform Residential Loan Application (URLA). The 30-day public comment period that will run through Dec. 13, 2025.

Tag: HUD

HUD Secretary Scott Turner: The Status Quo Is Not Good Enough

WASHINGTON–Department of Housing and Urban Development Secretary Scott Turner outlined some of his philosophy regarding his new role during the Mortgage Bankers Association’s National Advocacy Conference April 8.

HUD Announces 2025 Loan Limits

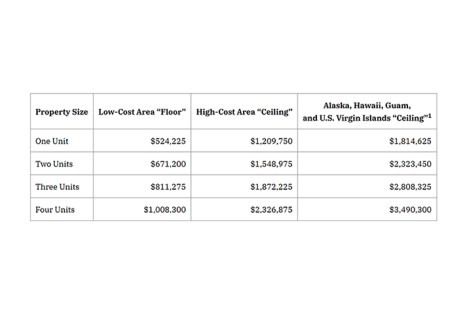

The Federal Housing Administration announced new loan limits for calendar year 2025 for its Single-Family Title II forward and Home Equity Conversion Mortgage insurance programs.

MBA-Recommended 203(k) Program Changes Adopted by HUD

HUD released an updated set of policies for its 203(k) Rehabilitation Mortgage Insurance Program, including a number of recommendations the Mortgage Bankers Association had suggested in a Jan. 3 letter.

MBA Urges HUD to Publish Notice About Ongoing Challenges With NSPIRE Protocol

The Mortgage Bankers Association asked HUD for assurance that servicers will not be held accountable for compliance with the new National Standards for the Physical Inspection of Real Estate (NSPIRE) system until it is “fully accessible and usable to each participant.”

Leveraging the Home Equity Conversion Mortgage for Purchase Program in Today’s Market: A Strategic Business Move for IMBs

Imagine a widow wanting to relocate to a cozy, manageable home for her golden years. With today’s higher mortgage rates and the high cost of living, her dream can feel out of reach. But what if there was a way to make it easier?

HUD Secretary Marcia L. Fudge to Resign March 22

Marcia L. Fudge, the 18th Secretary of the U.S. Department of Housing and Urban Development, announced she will resign effective March 22, 2024.

FHA’s Julia Gordon on 2024 Priorities at #MBACREF24

SAN DIEGO–Getting policies to the finish line–and what could hold that up–was the big theme from a discussion between Julia Gordon, Assistant Secretary for Housing and Federal Housing Commissioner at HUD, and MBA President and CEO Bob Broeksmit, CMB, here Feb. 13.

MBA Comments on HUD COVID-Related Loss Mitigation Report

The HUD Office of the Inspector General issued two audit reports Thursday examining the loss mitigation options that loan servicers provided to borrowers with FHA-insured loans after their COVID-19 forbearance ended.

MBA Comments on HUD COVID-Related Loss Mitigation Report

The HUD Office of the Inspector General issued two audit reports Thursday examining the loss mitigation options that loan servicers provided to borrowers with FHA-insured loans after their COVID-19 forbearance ended.