Cotality, Irvine, Calif., released its Homeowner Equity Report for Q3 2025, finding borrower equity decreased year-over-year by 2.1%.

Tag: Home Equity

Home Equity Growth Varies Across the U.S., Bankrate Reports

Certain parts of the country have seen higher home equity than others since 2020, according to a new study from Bankrate, New York.

Tapping Into Home Equity: MBA Q&A With BSI Financial Services’ Allen Price

MBA NewsLink recently interviewed Allen Price, senior vice president with BSI Financial Services, about how high rates, rising home equity and product innovation are reshaping the second-lien market and what that means for lenders, investors and servicers.

Nearly 30% of Homeowners Considering Home Equity Loans, MeridianLink Finds

Nearly three in 10 American homeowners are considering taking out a home equity loan or HELOC in the next 12 months, according to a new survey from MeridianLink, Costa Mesa, Calif.

Home Improvements Top Reason to Tap Home Equity, Bankrate Reports

More than half of current homeowners (55%) see home improvements or repairs as a good reason to access built-up home equity, according to Bankrate, New York.

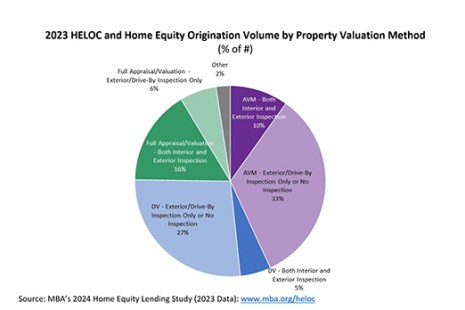

Chart of the Week: 2023 HELOC and Home Equity Origination Volume by Valuation Method

MBA recently completed its 2024 Home Equity Lending Study (covering 2023 data) tracking trends in origination and servicing operations for home equity lines of credit (HELOCs) and home equity loans.

MBA: Home Equity Lending Volume Rose in 2022 as Home Renovations Drive Demand

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased 50% in 2022 compared to two years earlier. This is according to the Mortgage Bankers Association’s Home Equity Lending Study, released for the first time since 2020.

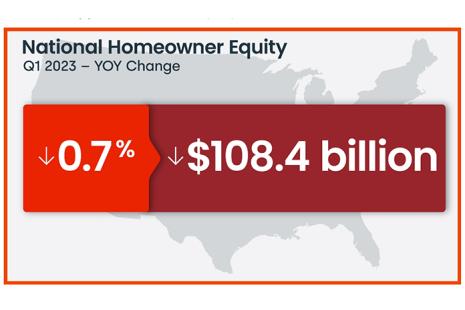

CoreLogic Reports Borrowers See First Annual Home Equity Losses Since 2012

U.S. homeowners with mortgages saw their home equity decrease by 0.7% year-over-year–an average loss of $5,400 per borrower–according to CoreLogic, Irvine, Calif.

Omar Jordan of LenderClose on the Evolving Home Equity Loan Market

Omar Jordan is Founder and CEO of LenderClose, West Des Moines, Iowa, a fintech that equips loan originators with the workflows needed to boost efficiencies and shorten the lending cycle through streamlined and meaningful integrations.

Despite Home-Equity Uptick, Black American Median Home Values Lag Behind

Despite promising data showing substantial gains in home equity, Black Americans still lag well behind other demographic cohorts, according to a new report from Redfin, Seattle.